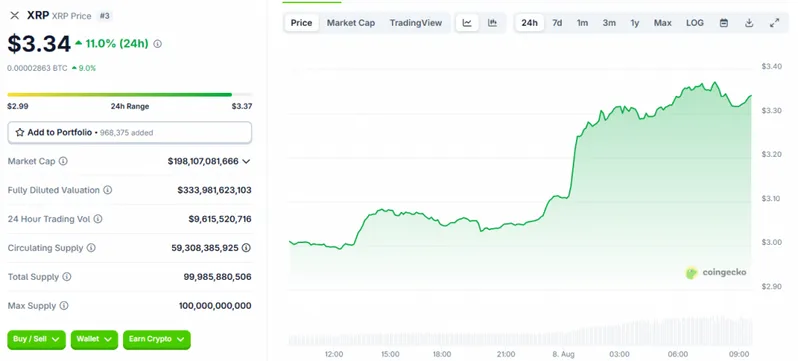

Ripple XRP price has been climbing quite impressively, actually reaching $3.34 with an 11% surge that traders are watching right now. The XRP price prediction models are being adjusted as Trump’s 401k executive order opens doors for digital assets in retirement accounts, and along with that, the XRP SEC case resolution is creating some momentum. At the time of writing, these 401k changes could help address 401k debanking concerns while also creating new pathways for crypto investment.

Also Read: XRP Breakout Nears: All Eyes on the Crucial $3.41 Threshold

Ripple XRP Price Rally and Prediction Amid 401k Changes, SEC Case & Trump Order

SEC Case Resolution Drives Ripple XRP Price Higher

The Securities and Exchange Commission and Ripple Labs have jointly dismissed their appeals, which has been removing regulatory uncertainty that clouded Ripple XRP price for years now. Trading volume actually exploded past 300 million as institutional buyers were accumulating their positions during peak hours.

Stuart Alderoty, Ripple’s chief legal officer, stated:

“Following the Commission’s vote today, the SEC and Ripple formally filed directly with the Second Circuit to dismiss their appeals.”

Following the Commission's vote today, the SEC and Ripple formally filed directly with the Second Circuit to dismiss their appeals.

— Stuart Alderoty (@s_alderoty) August 7, 2025

The end…and now back to business. https://t.co/nVqthNcFOt

Technical analysis is showing bull flag formations that point to $8-$15 targets, and new resistance has been forming at $3.33 while strong demand materializes above $3.10. The XRP price prediction outlook has improved significantly following this legal clarity, even as some traders remain cautious about market volatility.

Trump 401k Executive Order Opens Crypto Investment Doors

President Trump’s 401k executive order seeks to expand investment options in retirement accounts, including digital assets that could benefit Ripple XRP price through increased institutional access. The directive addresses 401k changes by instructing the Labor Department to reexamine fiduciary guidance under ERISA, along with providing broader diversification opportunities.

The order calls for relieving regulatory burdens to allow employers offering alternative investments, which cryptocurrency options are being included in. These 401k changes aim to provide access to the $12 trillion retirement market, even though implementation timelines are extending into 2026.

Market Impact and Future Ripple XRP Price Prediction

Implementation of these 401k changes won’t be immediate, actually, with new rules potentially taking into 2026. However, the prospect of retirement fund access is already influencing XRP price prediction models and market sentiment right now.

Lisa Gomez, former assistant secretary of labor for employee benefits security, stated:

“It’s going to be more complicated. For the right people under the right circumstances, with the right support and education, it could be helpful.”

Also Read: XRP Mirrors 2017’s 63,000% Rally as Ripple CTO Goes Independent

The convergence of SEC case resolution and potential 401k debanking solutions is positioning XRP for sustained growth, along with Japan’s SBI Holdings ETF filing adding another institutional demand driver. This supports bullish Ripple XRP price forecasts as regulatory clarity combines with expanded investment access, even as some market participants remain watchful of broader economic conditions.