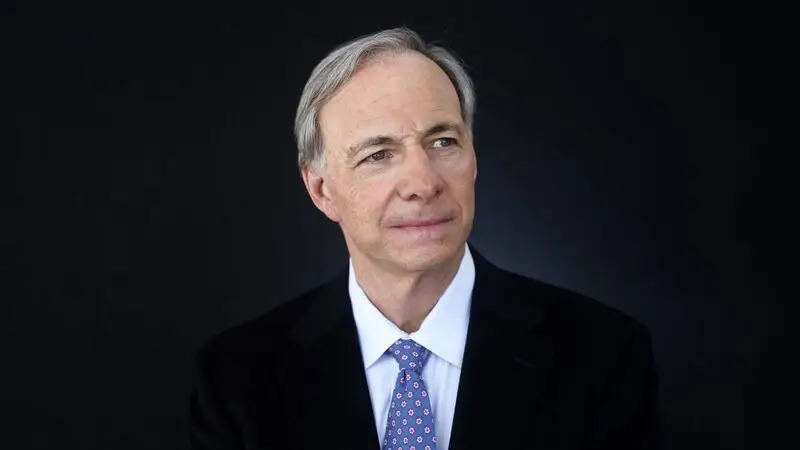

Billionaire and hedge-fund manager Ray Dalio is ringing the warning bells on the US dollar and the broader American economy. According to the billionaire, the US is in more trouble than portrayed by the Moody’s ratings, which downgraded America’s fiscal health. The Moody’s credit shock sent jitters in the markets, and now JP Morgan wrote in its latest piece that European stocks could outperform US assets.

Also Read: Trump’s Team Is Quietly Killing the US Dollar: 58% At Stake

On the heels of Moody’s downgrading the US credit rating to Aa1 from AAA, Ray Dalio warns that the troubled waters are deeper than portrayed. Moody’s wrote that fiscal deficits and political gridlock due to trade wars and tariffs are affecting the US economy. Dalio stressed that the ongoing trouble will affect other countries that have billions worth of US dollar bills in reserves.

Also Read: De-Dollarization: How CBDCs And China’s CIPS Threaten The Dollar

The US Economy & the Dollar Will Make the Economies of Other Countries Collapse, Says Ray Dalio

The billionaire warned that other countries will soon start printing more money to pay their debts, starting with the US. The development will plunge the global economy into new distress that could take decades to recover from. The US dollar will be the most hit currency as developing nations will find it risky to hold in their reserves.

Also Read: Goldman Sachs: MAG7 Hits 7-Year Low Amid AI, Trade & Antitrust Fears

“Regarding the US debt downgrade, you should know that credit ratings understate credit risks because they only rate the risk of the government not paying its debt,” he said. Dalio added, “They don’t include the greater risk that the countries in debt will print money to pay their debts, thus causing holders of the bonds to suffer losses from the decreased value of the money (US dollar) they’re getting. For those who care about the value of their money, the risks for US government debt are greater than the rating agencies are conveying,” he said.