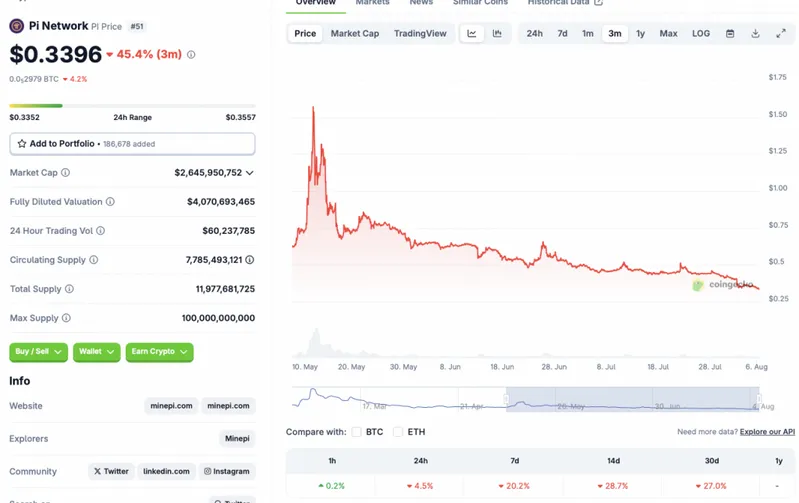

Pi Coin (Pi Network/PI) has faced quite a steep correction over the last few days, registering heavy losses for many. PI’s price is down 4.5% in the daily charts, 20.2% in the weekly charts, 28.7% in the 14-day charts, and 27% over the previous month. According to CoinGecko’s PI data, PI has registered the highest losses in the weekly charts among the top 100 projects.

Pi Coin Follows Cryptocurrency Market Losses

PI’s recent dip follows a market-wide correction. The correction came after the Federal Reserve announced its decision to keep interest rates unchanged. Market participants may have allocated their investments to other safe havens. PI is among the riskier assets in the market. With borrowing being difficult, investors may be staying away from crypto assets.

PI’s dip also comes amid global trade uncertainty. President Trump’s tariffs seem to have spooked investors away from risky assets. Along with the crypto market, the US stock market also faced a massive selloff last week.

Will The Asset Recover?

PI surged to an all-time high of $2.99 in late February of this year. While PI was climbing to its peak, the larger crypto market was facing a correction. The asset’s rally was likely due its open mainnet launch followed by a sudden rise in popularity. The rally, however, did not last very long. Since its February peak, PI’s price has fallen by 88.6%. The latest market correction added further fuel to the asset’s downward trajectory fire.

Also Read: Pi Coin Value in 2030 Set to Peak Near $1.87: What Could $1,000 Yield?

There is a high chance that the Federal Reserve will cut interest rates in September. The move could lead to a rise in investor confidence. Market participants may begin to take more risks as borrowing becomes easier. However, macroeconomic factors, such as trade wars and economic uncertainty, may present barriers to the PI’s price.