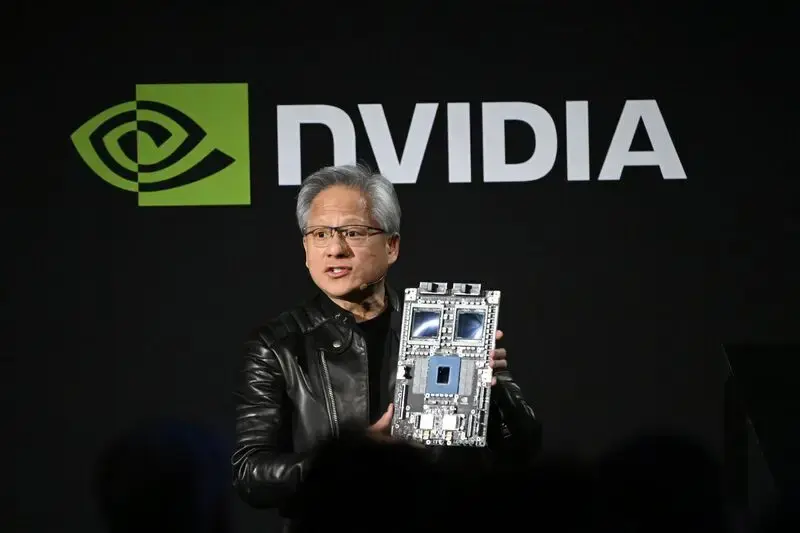

NVIDIA (NVDA) and Broadcom (AVGO) are both scheduled to post their next quarterly earnings just over a week apart. Both AI stocks have performed well as the AI sector continues to boom. However, one is bound to outperform the other when earnings season comes around in a few weeks.

NVIDIA will report its Q4 FY26 on February 25. Wall Street expects Nvidia to post Q4 FY26 earnings of $1.52 per share, up 70% from a year ago, with revenue projected to rise over 60% to $65.56 billion. Meanwhile, Broadcom will report its Q1 FY26 earnings on March 4. Analysts expect earnings of $2.02 per share, up from $1.60 a year ago, on revenue of $19.21 billion, representing 29% year-over-year growth.

Compared to Nvidia, Broadcom’s growth rates appear more modest, as Nvidia has been delivering significantly faster revenue expansion driven by surging demand for its AI GPUs. However, Broadcom’s growth is viewed as more diversified and potentially steadier, supported by its custom AI chips and networking business. Both AVGO and NVDA have buy ratings heading into earnings, but which stock has the best odds to bring investors the best return post-earnings?

Both Nvidia and Broadcom are strong AI stocks, but they offer different opportunities ahead of the earnings reports. NVIDIA still leads the AI chip market with strong demand and pricing power, hence it may be seen by most as the preferred choice. However, its high valuation means expectations are already very high, which could send the stock tumbling if the earnings don’t deliver. On the other hand, Broadcom is growing quickly in AI through its TPU and custom chip business and trades at a more reasonable valuation. In the last year, AVGO is up 46%, while NVDA trails slightly with a 44% rise.