Throughout the first three months of the year, the US stock market has certainly struggled. Even before US President Donald Trump’s Liberation Day tariff plan, the market’s mega-cap stocks had struggled to find any kind of momentum. That shifted for Nvidia (NVDA) on Tuesday as shares officially retook $100, but what could be next for the company?

Amid what was an increasingly volatile day for Wall Street, the AI chipmaker saw an impressive rebound take place. It certainly wasn’t alone, as firms like Tesla (TSLA) and Broadcom (AVGO) also performed well. However, with so much uncertainty abounding, is it a sign of things to come or just a small blip in its declining trend throughout this year?

Also Read: Investing Expert Calls to Buy Nvidia (NVDA) Stock Dip, Citing This Key Metric

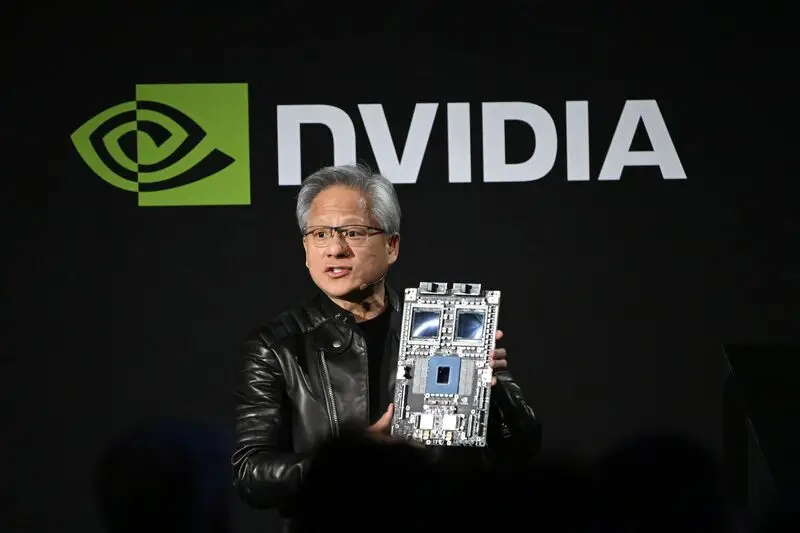

Nvidia Officially Retakes $100 as Stock Bounces Back From 2025 Downturn

As one of the biggest disappointments for the US stock market this year, things shifted for Nvidia on Tuesday. Specifically, the stock jumped almost 4%, hitting the $102 mark and reversing a 7.7% decline that took place over the last five days. Moreover, the entire market bounced back 4% amid a Trump tariff update, according to Bloomberg.

The question is, as Nvidia (NVDA) officially retakes the $100 level, what could be next for this stock? Despite its bearish performance, analysts are still bullish on the company. Among them is Bank of America, which has listed the firm among its top semiconductor picks after the US import taxes were announced last week.

Also Read: Nvidia (NVDA) Stock Gets Downgrade: Heres What Experts Are Saying

Analyst Vivik Arya recently said that no company will be immune from the impact of tariffs. However, businesses with a good balance sheet and strong fundamental exposure to AI, cloud, and computing will be better served in the long term. Nvidia certainly fits that mold.

“We believe the stock is providing a particularly attractive opportunity for one of the most unique, high-quality tech franchises leading the largest and fastest-growing secular trend,” Arya wrote.

Their bullish perspective is certainly not alone. Of 67 surveyed analysts by CNN, 91% have a buy rating on the stock. Moreover, it holds a median price target of $175, up 79% from its current position. Additionally, it is still showing a 141% upside, with its high-end projection sitting at $235.