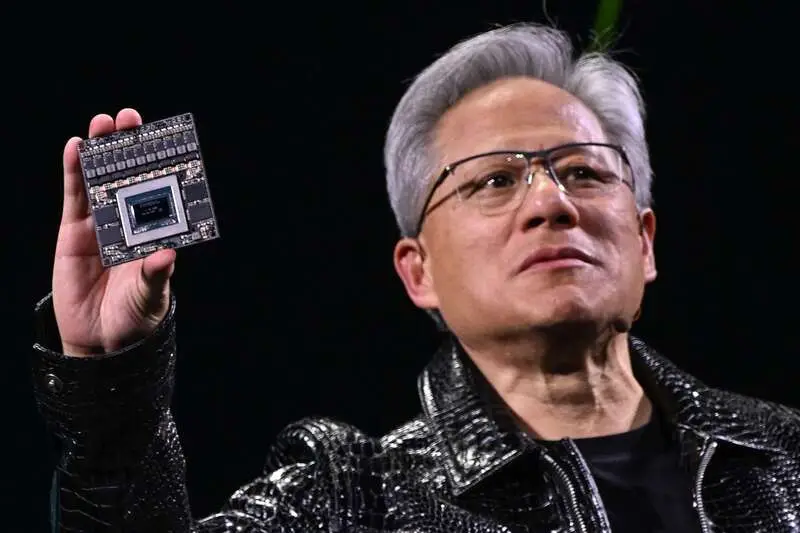

It has certainly been a tough few weeks for the US stock market. With geopolitical tensions exacerbated by increasingly aggressive economic policy, recession and trade war concerns have dominated investor sentiment. That is among the reasons why Nvidia (NVDA) has seen Citi Bank cut its price target to $150.

The stock had increased more than 174% last year, setting the stage for high expectations in 2025. However, three months into the year, the stock has failed to live up to this lofty projection and has succumbed to macroeconomic challenges. The question is, does it have any hope of outperforming its current outlook?

Also Read: Nvidia (NVDA): Can Tariff Pause Push Stock to $200

Citi Cuts Nvidia Price Target: What’s Next For The Stock?

Volatility and uncertainty have been the name of the game for Wall Street’s state in 2025. Indeed, that affected the market leader last year, Nvidia (NVDA). The AI chipmaker has failed to find its footing. Although it jumped more than 2.7% to end the week, it is still down more than 18% over the last six months.

There are many who expect this stock to change for the company. It is undoubtedly among the strongest in the tech sector, with experts being notably bullish on its potential. Yet, that is not the case for one investment firm, as Nvidia has seen Citi cut its price target to $150.

Also Read: Nvidia (NVDA) Retakes $114: Why Is Stock Surging Today?

The investment bank lowered its 2025 calendar year and 2026 GPU unit forecasts by 3% and 5%, respectively. Moreover, their earnings per share estimates saw a 3% reduction, with its price target being dropped from the previous $163.

The biggest reason for the downwardly revised outlook is the concern of a brewing US-China trade war. Yet, many Wall Street experts don’t share the concern, as the stock has a median price target of $175 currently. Moreover, its high-end project still sits at $235, showcasing 113% upside for its shares this year.