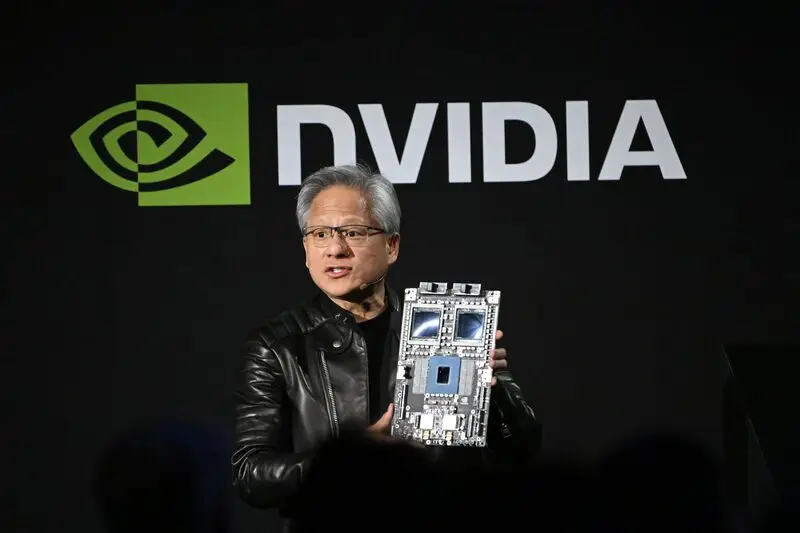

There are few companies that have a brighter future than those that are in the AI and tech space. Although things have not been strong this year amid increased macroeconomic uncertainty, that should change drastically in the coming years. Aligning with that optimism is Nvidia (NVDA), whose CEO, Jensen Huang, announced another key expansion as the stock stalls en route to $150.

The firm was one of the biggest winners of 2024, surging more than 174% over the course of the year. Things have been far different this year, with the stock market facing increasing sell-offs. Moreover, its reversal that started at the midpoint of May looks to be stalling yet again, from data that has investors spooked.

Also Read: NVIDIA and OpenAI partner with UAE to Build New AI Data Center

Nvidia Unveils Yet Another Expansion As Stock Struggles

The US stock market was hit with another piece of bad news on Monday. The Nasdaq and S&P 500 were all down from Moody’s decision to downgrade the US credit rating. Although US President Trump and his administration have been outspoken against the decision, it has been enough to send the market downward.

That drop has affected a host of the Magnificent 7. Yet, it has not deterred the optimism that these companies have for the future of the tech industry. That is clearly seen by Nvidia (NVDA), as CEO Jensen Huang has unveiled yet another key expansion, as the stock has stalled in its trip to $150.

Also Read: Nvidia Announces New Partnership to Build AI Factories in Saudi Arabia

Giving a keynote speech in Taipei to start the week, Huang announced the building of a new office in Taiwan. Specifically, with the help of Mayor Chiang Wan-an, they announced the imminent arrival of Nvidia Constellation, a major office in the country that will be featured in the Science Park area.

The move will have major implications for its operations. Indeed, according to CNBC’s Ray Wang, the new office will help the company with exports to China. Since the arrival of new tariffs on trading partners, its operations in the country have been threatened. However, things could address those issues, allowing the firm to benefit.

The company’s stock fell Monday as it sits at just $134. Still, its value has increased more than 39% over the last 30 days, with all eyes on the psychological $150 level. Currently, it has a median price target of $160, up 18% from its current value.