Nike stock rallied after the athletic apparel giant reported fiscal Q1 2026 earnings that actually beat analyst expectations, with earnings per share coming in at $0.49. The Nike stock price moved higher even though China revenues dropped by 10%, and investors are now examining the Nike earnings report to figure out if Nike stock today represents real value. Nike earnings 2025 results indicated that the company was outperforming the Wall Street estimates, yet Nike stock price is currently under some pressure due to the China market downturn and other headwinds.

Nike Stock Price Outlook After EPS Beat and Weak China Earnings

Q1 Earnings Show Mixed Results

The fiscal first quarter results revealed that Nike stock is facing headwinds as revenue was down 10% year-over-year to $11.59 billion. Greater China revenues declined 10%, along with North America dropping 11%, and EMEA falling 8%. Despite these revenue challenges, Nike earnings came in ahead of estimates due to margin improvements, with gross margin expanding 120 basis points to 45.4%.

In response to the Nike earnings news, the CEO Elliott Hill said that the company is looking at the core athletic performance categories. During the earnings call, CFO Matthew Friend observed that there is anticipated pressure in the near term, but there have been some prospects that actual execution of both the supply chain and retail channels can be improved by the time of writing.

Also Read: Nike Stock (NKE) Climbs After US-Vietnam Trade Deal

China Market Remains Key Concern

The fact that Greater China revenue has fallen by 10 percent still haunts Nike today, with local brands gaining market share such as Anta and Li-Ning. It is in the process of updating product lineups and also working to improve relationships with retailers, however the turnaround will take time. Investors in Nike stocks are keeping a close eye on this market, where the company is facing a very important opportunity to grow its brand.

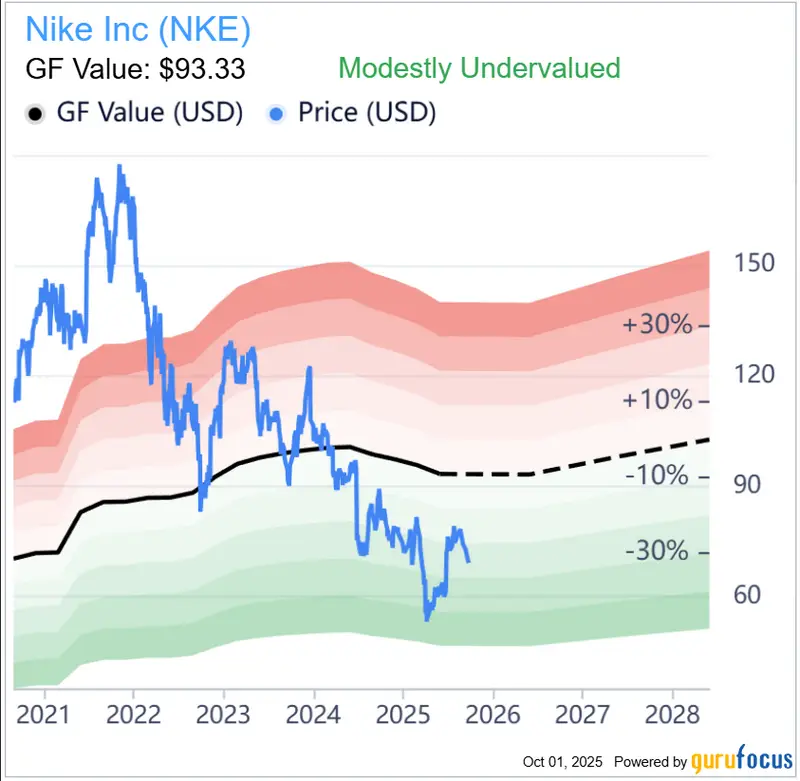

Analysts are cautiously optimistic on Nike stock with some upgrading stock ratings on the basis of beat on EPS and higher margin. The uncertainty exists in the Nike stock price at the moment, yet Nike brand and financial base can lead to the future recovery of the company in case the execution will be better over the next several quarters and Nike earnings 2025 will begin to improve.

Also Read: Dick’s $1.5B Foot Locker Buy Could Drive Nike Stock Up 22%