Nike stock is seeing some renewed interest after the Dick’s Sporting Goods company announced that it’s planning on spending $1.5 for the acquisition of Foot Locker. This retail consolidation in the United States dollar economy could, in fact, reshape the sporting goods landscape. At the time of writing, analysts are actually predicting a potential 22% upswing for Nike stock following this strategic acquisition.

Also Read: Arthur Hayes Predicts The Start Of Altcoin Season & Its Sooner Than You Think

How Dick’s Sporting Goods May Boost Nike Stock and Retail Power

Strengthening Nike’s Distribution Network

Currently, Nike stock is expected to benefit significantly as Dick’s Sporting Goods’ purchase of Foot Locker creates a retail powerhouse. The footwear giant’s distribution channels will be strengthened by this merger, and also create additional opportunities for growth.

Maria Chen, retail analyst at Bloomberg Markets, stated: “This acquisition creates a retail powerhouse that will likely become Nike’s most important North American partner.”

The combined network of over 1,700 stores is predicted to boost Nike stock through improved inventory management and, additionally, more efficient sales channels.

Financial Impact on Nike Stock

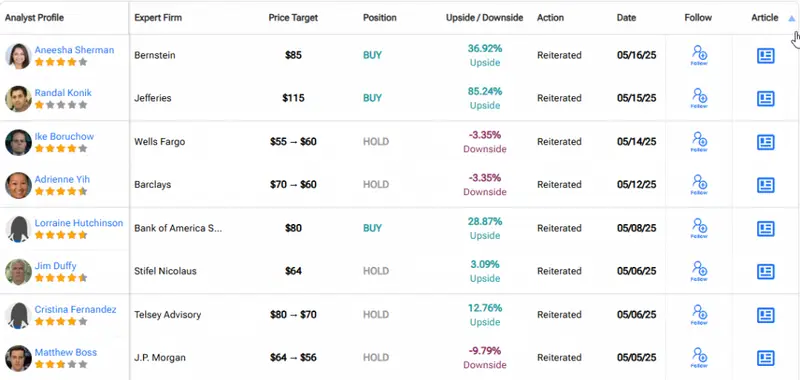

Investment banks have recently revised their price targets for Nike stock following the announcement. The United States dollar value of Nike shares jumped 4.3% immediately after the news broke, with trading volume nearly triple the daily average.

James Wilson, Senior Equity Analyst at Morgan Stanley, explained: “The consolidation of these two major retail partners creates significant opportunities for Nike to optimize its inventory management and marketing efficiency.”

Also Read: Trump’s Team Is Quietly Killing the US Dollar: 58% At Stake

Competitive Advantage for Nike Stock

The merger positions Nike stock favorably compared to competitors, such as Adidas and Under Armour. Both Dick’s Sporting Goods and Foot Locker maintain strong partnerships with Nike, and the consolidated operation could possibly give Nike products preferential treatment in stores.

Sarah Johnson, Chief Market Strategist at Fidelity Investments, noted: “Nike’s existing relationships with both Dick’s and Foot Locker position it uniquely to capitalize on this merger.”

Future Outlook

The acquisition is expected to be completed by latest Q3 2025, pending some various regulatory approvals. Many industry experts believe that the well-known Nike stock stands to gain the most from this latest retail consolidation.

Richard Johnson, CEO of Dick’s Sporting Goods, said: “This strategic move positions us as the undisputed leader in athletic retail.”

Also Read: India’s Supreme Court Favors Regulation Over Complete Cryptocurrency Ban

At the time of writing, some analysts for Nike project that acquiring the Converse brand could also increase the company’s annual revenue by $1.2 billion by the year of 2026. This would be contributing to the 22% growth projection reported by numerous financial institutions.