Netflix’s stock valuation has actually reached some pretty critical levels right now as shares have surged an impressive 86% while trading at around 44 times earnings. Many investors are questioning this Netflix stock valuation, and the Netflix earnings forecast shows some mixed signals along with Netflix growth potential facing headwinds. A lot of analysts are asking: is Netflix stock overvalued at these current levels?

Netflix Stock Valuation Raises Concerns Amid Strong Growth Forecast

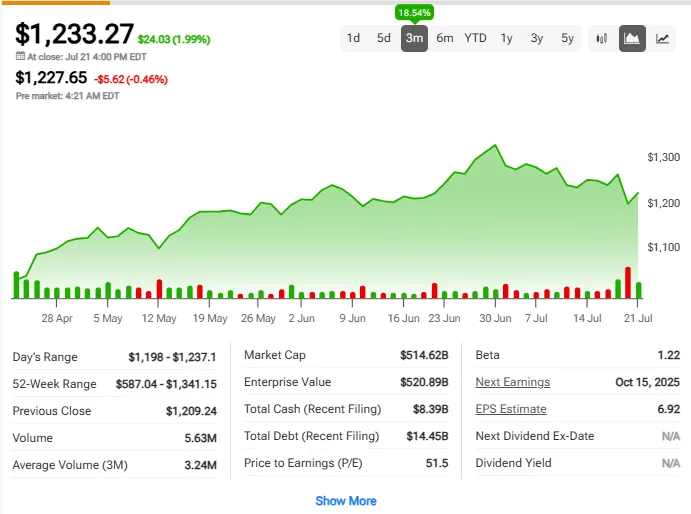

The streaming giant’s Netflix price to earnings ratio of 51.5x has actually sparked quite a bit of debate among Wall Street analysts right now. Current Netflix stock valuation metrics show the company is trading at $1,233 per share, which represents a significant premium that’s getting harder to justify.

Analyst Sentiment Mixed Despite Strong Performance

Based on the analyst data we’re seeing, 36 Wall Street analysts weigh in on Netflix stock valuation with what they call a “Moderate Buy” rating. The breakdown actually reveals 26 buy ratings, 10 hold recommendations, and even zero sell ratings, which suggests some cautious optimism despite the valuation concerns that are mounting.

The Netflix earnings forecast is showing an average price target of $1,412.67, which implies about 14.55% upside potential from here. However, these targets are ranging from $1,600 all the way down to $1,100, highlighting some significant disagreement about whether Netflix stock is overvalued at the moment.

Also Read: $0.50 to $4.80: Opendoor Stock’s Shocking 860% Surge in Weeks

Growth Metrics Paint Complex Picture

Analysts still see that Netflix’s growth potential is still a key driver behind current Netflix stock valuation levels. Revenue growth of 14.28% along with EPS growth of 46.86% actually support the bull case, though this Netflix price to earnings ratio suggests the market may be pricing in perfection at this point.

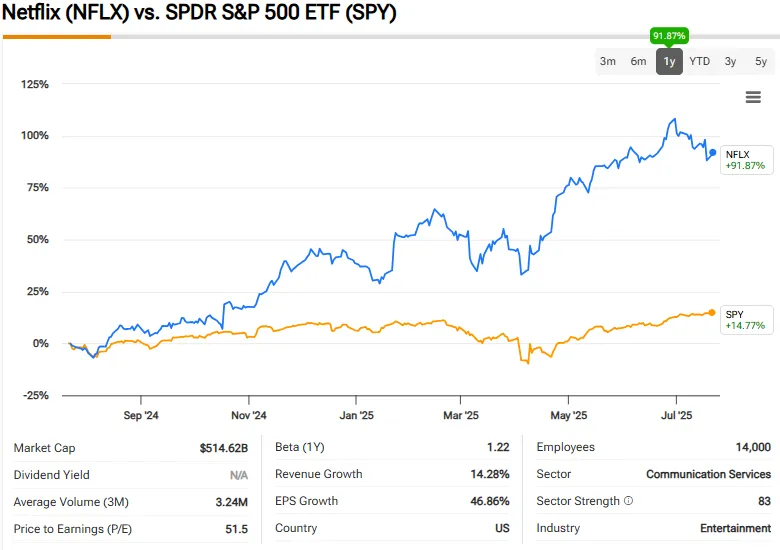

The company’s performance versus the S&P 500 has been quite remarkable, with Netflix delivering 91.87% returns compared to the index’s 14.77% gain over this past year.

Valuation Concerns Mount

The current Netflix stock valuation of $514.62 billion in market cap and $520.89 billion enterprise value actually reflects some extremely high growth expectations. With debt levels at $14.45 billion and a Netflix price to earnings ratio that’s exceeding 50x, investors are paying quite a steep premium right now.

The Netflix earnings forecast will be crucial in determining whether current Netflix valuation levels can actually be justified. Netflix’s growth potential must deliver exceptional results to support these multiples.

Also Read: US Stock Market Rally Not Over, Will Go Much Higher, Says JP Morgan

Netflix stock valuation ultimately hinges on execution at this point. The company’s proven track record does support some optimism, but the mathematical reality suggests that maintaining 86% annual gains will prove challenging from this elevated Netflix stock valuation base.