Windtree Therapeutics (WINT) has entered into a Common Stock Purchase Agreement for up to $500 million to establish an equity line of credit. The Nasdaq-listed company intends to diversify its portfolio and further strengthen its Binance Coin (BNB) treasury. According to CEO Jed Latkin, “We are excited to incorporate these new facilities to enable our future BNB acquisitions as part of our BNB treasury strategy. Pending stockholder approval, the opportunity to secure additional funds for purchasing more BNB cryptocurrency is essential to our strategy.“

Binance Coin’s Price Dips Amid Market Correction

The Nasdaq-listed company’s decision to increase its BNB exposure follows a larger trend. More and more corporate entities are stocking up on crypto as part of their treasury strategy.

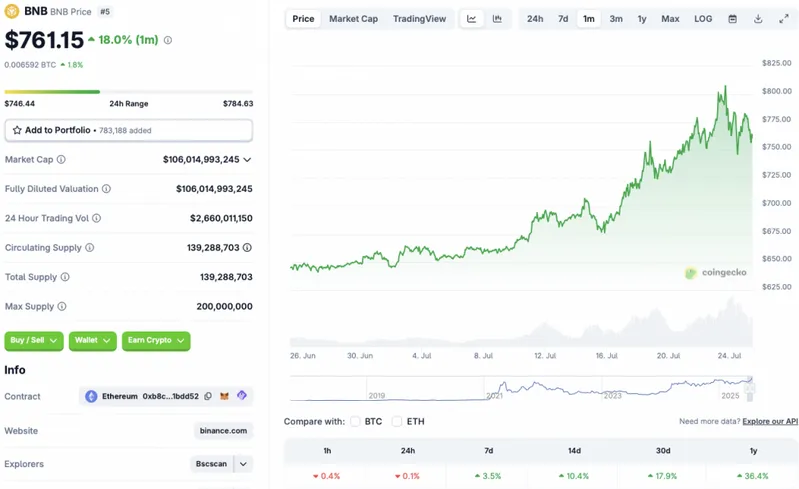

The cryptocurrency market has faced a steep correction since yesterday, July 24, 2025. BNB has registered a 0.1% dip in the daily charts, but is up in the other time frames. BNB is still up by 3.5% in the weekly charts, 10.4% in the 14-day charts, 17.9% over the previous month, and 36.4% since July 2024. Bitcoin (BTC), on the other hand, has fallen 2% in the daily charts and 4.2% in the weekly charts.

The market correction was likely due to increased profit-taking after the recent surge. Binance’s BNB coin hit a new all-time high of $808.09 on July 23. BNB’s rise came on the heels of Bitcoin (BTC) and XRP hitting new all-time highs of $122,838 and $3.65, respectively. Investors may have decided to book profits after the climb.

Also Read: By 2030: Your $1K BNB Investment Could Explode to This

There is a chance that the crypto market will pick up pace over the coming weeks. Bitcoin (BTC) had a supply gap at the $110,000 to $115,000 level. BTC’s price dropping to this level was very likely. We could see a reversal as prices mitigate.

There is also a high chance that the Federal Reserve will cut interest rates soon. President Trump has pushed for a rate cut for quite some time. A dip in interest rates will likely lead to a spike in risky investments as borrowing becomes easier. Binance Coin (BNB) and other cryptocurrencies could see a surge under such conditions.