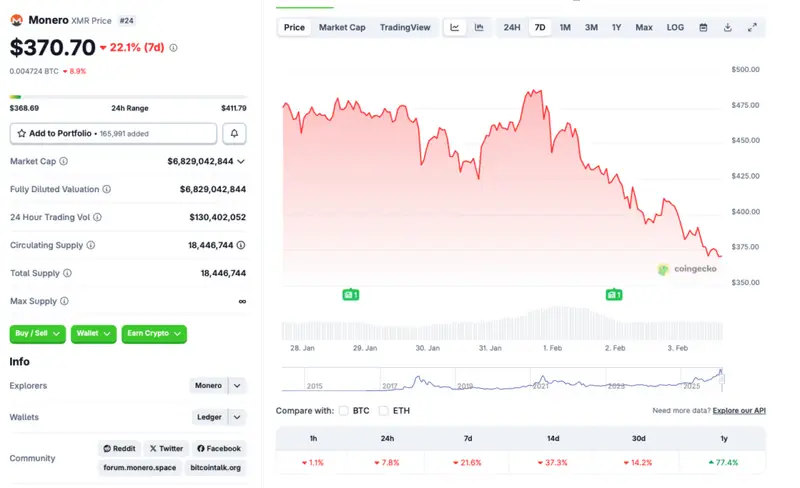

Monero (XMR) had quite a bullish breakout since late 2025 till it hit an all-time high of $797.73 on Jan. 4, 2026. However, the privacy-focussed cryptocurrency has crashed by more than 53% since its January 2026 peak. The recent market crash has further deepened XMR’s correction. According to CoinGecko statistics, XMR’s price has fallen 7.8% in the last 24 hours, 21.6% in the last week, 37.3% in the 14-day charts, and 14.2% over the previous month. Nonetheless, the asset has maintained substantial gains over the yearly charts, rallying 77.4% since February 2025. Let’s discuss if Monero (XMR) can rebound from its current bearish trajectory, or will it continue dipping.

Can Monero Reclaim Its All-Time High Price Levels?

Monero (XMR) began its upward momentum in late 2025, while other crypto assets were facing steep price corrections. The crypto market was hit with its most significant liquidation event in October of last year. While most assets were registering massive losses, XMR was seeing inflows. Monero’s (XMR) rally was likely due to a surge in demand for privacy-focussed cryptocurrencies. Other privacy coins, such as Zcash (ZEC), also saw big gains.

Also Read: Bitcoin Reclaims $78,000 After Trump’s Pro-Crypto Remark

Monero’s (XMR) rally was further propelled by Zcash’s internal conflicts which led to the exodus of its core developers. The move may have led to investors pulling out of ZEC, and pouring their funds into XMR. The development likely led to Monero (XMR) hitting an all-time high in January of this year.

However, the crypto market faced substantial struggles over the last few weeks, with Bitcoin (BTC) briefly dipping below the $75,000 mark. Given the larger market bearishness, it is unlikely that Monero (XMR) will reclaim its all-time high price levels just yet. The asset could enter a sideways trajectory and prices could consolidate around current levels over the coming days. However, a breakout could be a little farfetched.