Microsoft stock surged more than 2.5% on Wednesday, reaching the $426 mark on the closing bell. MSFT spiked more than 10 points in the day’s trade and is attracting bullish sentiments in the charts. It went from a low of $419 to a high of $428 in a day and settled at the $426 price range. Leading Wall Street analysts remain bullish on Microsoft stock’s prospects in 2025 and provide a positive price prediction.

Also Read: 6 U.S. Stocks That Nvidia Owns

Wall Street Analysts Bullish Price Prediction For Microsoft Stock (MSFT)

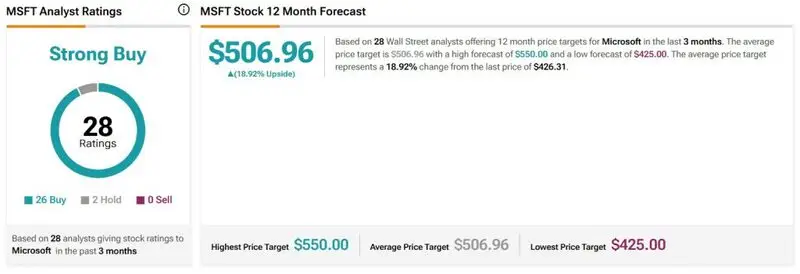

Leading Wall Street strategists have given Microsoft a ‘buy’ call, indicating that its best days are ahead. 26 analysts have provided a ‘buy’ call, and two analysts have given a ‘hold’ call for MSFT, according to TipRanks. The tech giant could deliver better returns this year as it is poised for an upward swing.

Also Read: Internal De-Dollarization: Study Finds 52% of Americans Prefer Crypto Over Traditional Assets

The price prediction estimates that Microsoft stock could reach a high of $550 in the next 12 months. That’s an uptick and return on investment of approximately 29% from its current price of $426. Therefore, an investment of $1,000 could turn into $1,290 in the next 12 months if the forecast turns out to be accurate.

Also Read: Reliance Jio Joins Forces with Polygon – What This Means for Crypto in India

Also, the price prediction estimates that the average trading price for MSFT stock could move around the $506 range. That’s a return of 19% and is a decent return for the short-term period. This puts Microsoft on the ‘must buy’ list as it has a good upward trajectory in 2025 placed by analysts. Tech giants generally tend to generate stellar profits if investors hold on for the long term.

“Based on 28 Wall Street analysts offering 12-month price targets for Microsoft in the last 3 months. The average price target is $506.96 with a high forecast of $550.00 and a low forecast of $425.00. The average price target represents an 18.92% change from the last price of $426.31,” read the prediction.