Markets flash green right now as major cryptocurrencies and stocks rally following the recently eased US-China trade tensions. Arthur Hayes’ crypto prediction to “buy everything” has certainly sparked some optimism as Bitcoin’s price surged, while the broader crypto market recovery also gained momentum. The US-China trade deal has definitely got markets flashing green across both traditional and digital assets at the time of writing.

Also Read: BlackRock & SEC Clash Over Cardano’s Aggressive Pivot

Crypto Sentiment Shifts As Hayes, China Deal Spark Price Rally

US-China Trade Deal Ignites Market Optimism

Markets flash green after the United States and China reached a significant trade agreement just yesterday. Beijing has reduced duties on U.S. goods from 125% to 10%, while Washington also decreased tolls on Chinese imports to 30% from 145%. These reductions will take effect May 14 and last for 90 days, according to an official White House statement released earlier this week.

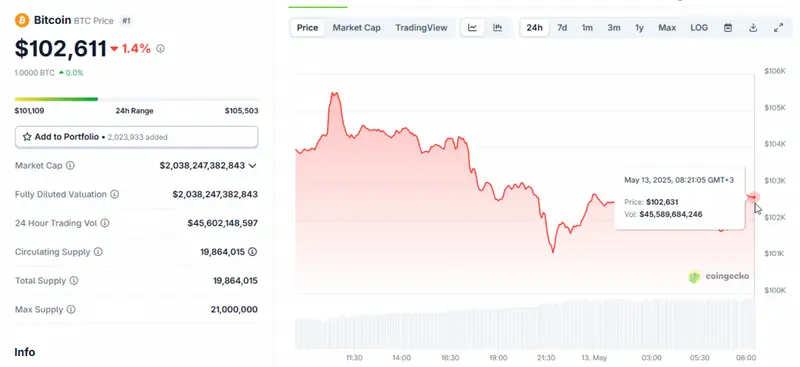

Bitcoin is currently trading above $102,611 and Ethereum sits at around $2,500, with other cryptocurrencies such as XRP and ADA also seeing green. The GMCI 30 Index grew over 2% as the crypto market recovery continues to gain traction. Traditional markets have also responded positively to the trade news, with futures tied to the S&P 500, Nasdaq, Dow Jones, and Russell 2000 rallying upwards of 2% in recent trading.

Dr. Kirill Kretov, senior automation expert at CoinPanel, told The Block:

“For crypto, this reduction in trade tensions supports a risk-on environment. Lower tariffs ease inflationary pressures and improve global liquidity conditions, both of which are typically bullish for Bitcoin and other cryptocurrencies.”

Hayes’ Bold “Buy Everything” Declaration

Maelstrom CIO Arthur Hayes shared his bullish crypto prediction as trade tensions between the economic giants began to ease. His post on X platform simply instructed traders to “buy everything,” reflecting what analysts call strong market confidence.

This Arthur Hayes crypto prediction came exactly as markets flash green across multiple asset classes, creating what some see as a potential turning point.

Also Read: University of Brighton Professor Predicts Ripple (XRP) to Reach $6.10

Broader Factors Supporting Crypto Market Recovery

The US-China trade deal crypto impact extends beyond digital currencies. President Trump also announced a trade deal with the United Kingdom recently, while the U.S. Office of the Comptroller of the Currency published guidance stating that national banks can buy and sell customers’ crypto and also custody crypto assets with third parties.

The Bitcoin price surge followed these developments almost immediately, with the flagship cryptocurrency pushing beyond the $100,000 threshold. Ethereum also experienced its largest daily uptick in four years, bolstered by both the positive macro outlook and the successful implementation of the bug-free Pectra upgrade.

Paul Brashier, vice president of global supply chain at ITS Logistics, stated:

“I have clients with thousands of containers pre-loaded in China that is ready to come in.”

Volatility Signals Point to Further Growth

The ongoing crypto market recovery continues to show interesting volatility patterns between the top cryptocurrencies. Bitcoin’s 7-day volatility has risen moderately from 37% to 42%, while Ethereum’s metrics show much more dramatic movement in recent days.

Dr. Sean Dawson, Head of Research at Derive.xyz, wrote in a May 12 note:

“ETH volatility, on the other hand, has surged dramatically from 52% to nearly 90%, before stabilizing just over 80%. This indicates that ETH is expected to experience far more explosive price movements.”

Also Read: Eric Trump’s Bitcoin Firm to Go Public in New Nasdaq Merger Deal

Dawson has also projected Ethereum possibly revisiting the $4,000 range and outperforming Bitcoin in the coming months. For Bitcoin itself, he suggested that $150,000 was a reasonable target for 2025, while also noting that even $200,000 was “not impossible” given current market conditions.

Dr. Dawson further remarked:

“The market is showing renewed optimism, and volatility suggests that BTC and ETH are positioned for significant movements in the months ahead. With institutional adoption growing and macroeconomic factors stabilizing, the outlook remains bullish for the remainder of the year.”

As markets flash green today, investors are definitely watching whether this Arthur Hayes crypto prediction will materialize into a sustained Bitcoin price surge or if the crypto market recovery might require additional catalysts beyond just the US-China trade deal crypto news that has dominated headlines this week.