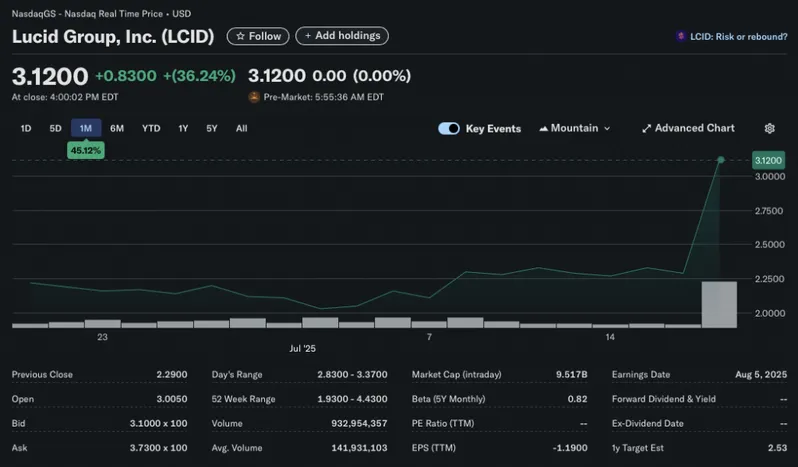

Lucid Group, Inc.’s stock (LCID) has surged by 36.24% after the company announced a new deal with Uber. The electric vehicle manufacturer’s share price shot up yesterday by 50% before settling at the 36% mark. Uber is set to invest $300 million in the EV maker towards its self-driving taxi fleet. The transportation company has announced a strategic partnership with Lucid and the autonomous driving startup Nuro.

What’s Next For Lucid: Should You Buy The Stock?

The Uber-Lucid-Nuro partnership put the trio in direct competition with Tesla’s latest self-driving taxis and Alphabet’s Waymo platform. Uber already has a partnership with Waymo, which could be hampered in light of recent events.

While the market has responded positively to Uber’s new partnership, one analyst has expressed concerns about Lucid’s future performance. According to Wedbush analyst Scott Devitt, the new deal has brought to light many issues that Uber faces. In a note to shareholders, Devitt stated that the deal “puts the Waymo relationship at risk, impairs the capital efficiency story, and comes with major execution risk given Lucid and Nuro as partners.” According to the analyst, Lucid will need more capital to deliver on Uber’s production requests.

Uber CEO Dara Khosrowshahi is quite optimistic about the deal. Khosrowshahi says that the partnership is “purpose-built just for the Uber platform.“

Also Read: Tesla (TSLA) Stock Climbs After Elon Musk’s Big Weekend

One edge that the Uber-Luci-Nuro team will have is the EV maker’s luxury vehicles. Lucid’s cars are far more expensive than an average luxury cab on Uber. The availability of luxury cars could carve out a niche group of clients.

How Lucid’s share price behaves over the coming weeks is yet to be seen. Many anticipate a continued rally. Others think the partnership’s goals may not be sustainable. Masses may need fuel for excitement to keep the rally going.