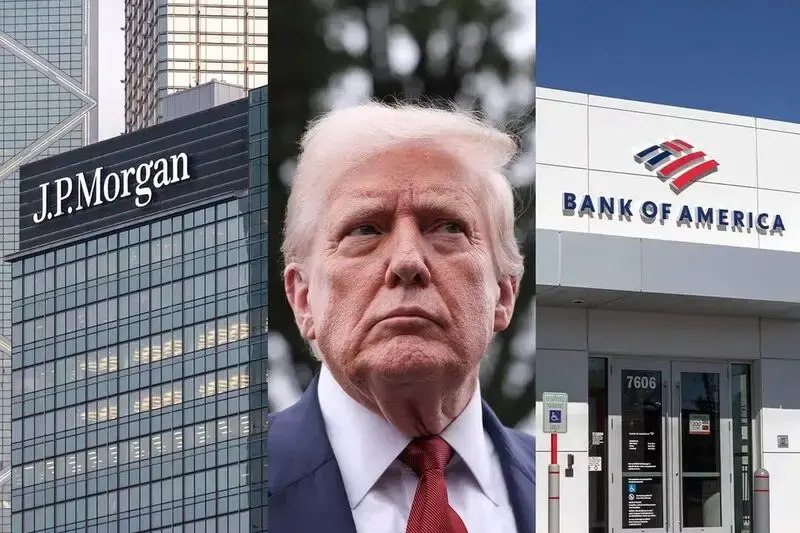

JPMorgan’s Fed forecast indicates the Federal Reserve will actually halt quantitative tightening as soon as next week, and Bank of America QT strategists are now agreeing on this accelerated timeline. Both major Wall Street banks moved their forecasts forward from December to the October 28-29 FOMC meeting after observing mounting stress in dollar funding markets right now. Powell reserves have fallen below $3 trillion, and the Fed liquidity pivot appears imminent as signs of reserve scarcity are emerging across the financial system at the time of writing.

JPMorgan, BofA Forecast Fed Liquidity Pivot Amid QT and Reserve Signals

Wall Street Banks Accelerate QT End Forecasts

The shift in expectations was driven by recent developments in funding markets, along with some technical indicators that caught analysts’ attention. JPMorgan strategist Teresa Ho stated:

“Markets have been operating with much more frictions.”

Bank of America’s Mark Cabana and Katie Craig had this to say:

“Money markets at current or higher levels should signal to the Fed that reserves are no longer ‘abundant.'”

The JPMorgan Fed forecast revision came after both banks observed elevated rates in the repurchase agreement market, and also the overnight reverse repo facility approaching zero. The quantitative tightening program has been draining roughly $2.2 trillion from the Fed’s balance sheet since June 2022, bringing it down from nearly $9 trillion to approximately $6.6 trillion right now.

Powell Signals Imminent End to Balance Sheet Runoff

Fed Chair Jerome Powell said in his October 14 speech:

“Our long-stated plan is to stop balance sheet runoff when reserves are somewhat above the level we judge consistent with ample reserve conditions. We may approach that point in coming months.”

Powell also noted:

“Some signs have begun to emerge that liquidity conditions are gradually tightening, including a general firming of repo rates along with more noticeable but temporary pressures on selected dates.”

Also Read: Fed Rate Hike Sparks $320B Selloff as Bitcoin ETF Hype Fades

The comments were seen as a dovish signal by markets, even though Powell didn’t provide a specific date for when the program would end.

Impact on Bitcoin and Crypto Markets

The end of quantitative tightening could actually provide fresh liquidity for risk assets like cryptocurrencies. Bitcoin has been trading around $108,900 recently, down 4.52% in October, as markets await the Fed’s next move. The JPMorgan Fed forecast suggests that removing this liquidity drain could trigger upward momentum for digital assets. Market analyst Michaël van de Poppe expects the FOMC meeting and potential Fed liquidity pivot to spark Bitcoin’s next significant price movement, along with broader gains across the crypto sector.

Also Read: IRS 2026 Federal Income Tax Brackets Updated for Inflation