A yen-backed stablecoin in Japan launched officially through JPYC on October 27, 2025, and it’s actually marking the first regulated digital yen that’s available on public blockchains right now. The Tokyo-based fintech firm received authorization from Japan’s Financial Services Agency to issue JPYC, which is backed one-to-one by bank deposits and also Japanese government bonds. This yen-backed stablecoin in Japan represents a major development for stablecoin regulation, along with digital yen adoption, and even Japan crypto adoption.

JPYC’s Yen Stablecoin Signals Japan’s Crypto Adoption and Regulation Shift

CEO Announces Historic Launch of Yen-Backed Stablecoin in Japan

At a press conference in Tokyo, JPYC President Noriyoshi Okabe stated:

“The stablecoin from his company is a major milestone in the history of Japanese currency.”

CEO Noritaka Okabe also said:

“We can deliver yen to billions of people, and ultimately we want to contribute to improving the value of the Japan yen.”

The digital yen operates on multiple blockchain networks, including Ethereum, Polygon, and also Avalanche. JPYC was launched alongside JPYC EX, which is a dedicated platform for issuing and redeeming tokens under Japan’s Act on Prevention of Transfer of Criminal Proceeds. Seven companies have already expressed interest in incorporating Japanese Yen Coin into their operations, which is addressing concerns about limited Japan crypto adoption.

Also Read: Japan’s Megabanks Launch Stablecoins to Power Global Corporate Payments

Ambitious Growth Plans and Stablecoin Regulation Impact

According to JPYC’s official statement, the company aims to:

“Achieve an issuance balance of 10 trillion yen over the next three years and only then take on the challenge of creating a new social infrastructure through stablecoins.”

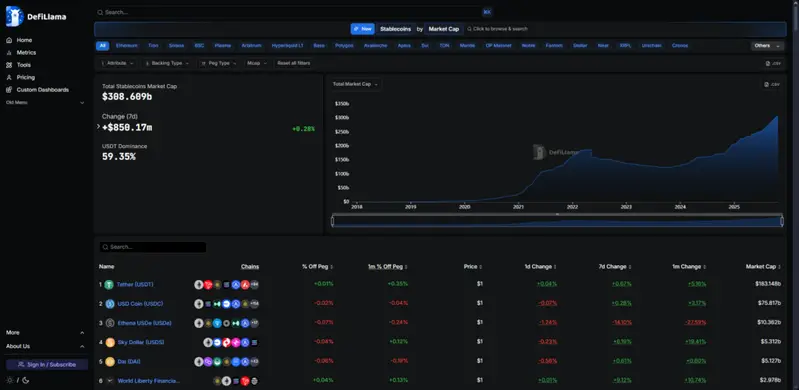

All dollar-pegged assets are winning big as i’m writing this piece. Competition has also begun to emerge, with three of the largest Japanese banks, namely, Mitsubishi UFJ Financial Group, Sumitomo Mitsui Banking Corp., and Mizuho Bank, proposing their own yen-backed stablecoin on the Progmat platform called MUFG. It means that the regulation of stablecoins in Japan is fueling a shift to wider institutional involvement in digital yen projects and also Japan crypto adoption.

Also Read: Fed Rate Cut, China Trade Deal, Big Tech Lift Dow Futures