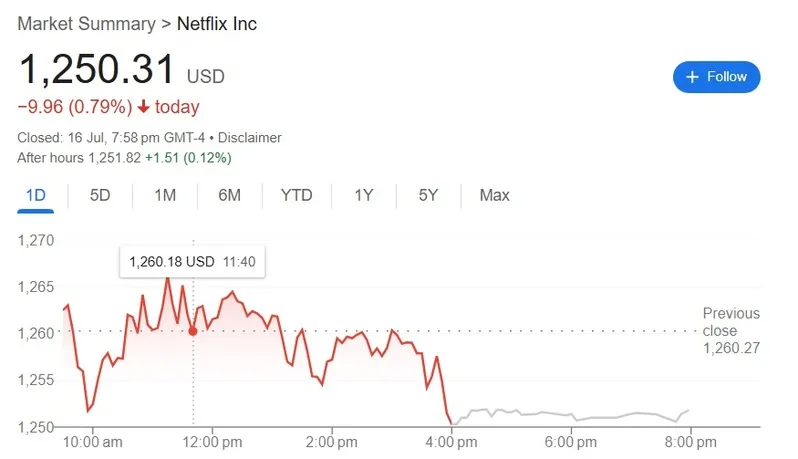

Netflix (NASDAQ: NFLX) stock is on a roll in 2025 as it surged nearly 40% year-to-date. It stepped into January trading at $886 and is now hovering at the $1,250 mark on Thursday. In a year alone, NFLX has spiked close to 90% and is among the top-performing stocks in the US markets.

Now that Netflix is displaying strong resilience, could this be the best stock to buy for the long term? In this article, we will highlight a price prediction on how high or low NFLX could trade in the charts by 2030. A 5-year holding period usually turns into profit, and we will explain and weigh in on the equity’s prospects.

Also Read: Apple (AAPL) Stock Down 16%: Will Earnings Spark a Rebound?

Netflix Stock 2030 Price Prediction (NFLX)

Leading US stock market prediction firm Traders Union has painted a bullish picture for Netflix in 2030. According to the price prediction, NFLX could surge by double-digits in the next five years, delivering profits to present-day investors. The forecast indicates that the minimum price could hover around the $1,678 level mid-year in 2030.

However, the maximum price Netflix stock could reach in 2030 is projected at the $1,729 level. Therefore, investors could expect 34% to 38% profits for the 5-year long-term period. An investment of $10,000 now could turn into $16,750 or $17,250 if the price prediction turns out to be accurate.

What To Expect For the Short Term?

The Q2 earnings call is scheduled on Thursday, which could dictate the direction of NFLX stock. The expectations for Netflix remain optimistic, with Wall Street projecting a revenue of $11.05 billion. The Q1 earnings soared 31.7% and experts predict it could soar by 1.6% and reach 33.3%.

Also Read: Circle (CRCL) Stock Surges After House Passes Crypto Legislation

If the Q2 earnings call goes above the market expectations, Netflix stock could rally in the charts. Also, if the earnings remain stagnant or turn negative, NFLX could plunge in the indices. It is best to wait for the earnings call today before taking an entry position in the equity due to volatility.