DBS bumped up the JPMorgan price target to $290, and this actually represents a pretty significant 23% boost from where it was before. This JPMorgan stock forecast shows strong confidence in the banking giant’s performance, especially with the US banking sector trends that are happening right now across the industry.

DBS Bank Price Target Shows Banking Sector Is Doing Well

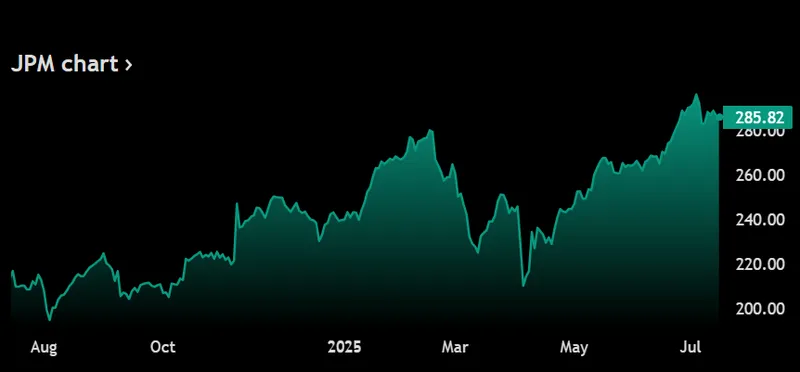

The reinstated DBS JPMorgan price target is at a time when the bank has been experiencing strong fundamentals as well as comparatively good results in operations as well. The JPMorgan stock has by now been trending at the rough value of 285.82.

Banks Are Well Off So Target Changes

The JPMorgan earnings report has been exceeding what analysts expected, and the bank has been benefiting from rising interest rates along with improved lending conditions. US banking sector trends show continued strength across major financial institutions, even with some of the economic uncertainty that’s out there.

The move to the most recent DBS JPMorgan price target is also evidence of how the bank has diversified its revenue base and also accrued a very strong capital base over an extended period. Investment banking operations are however improving, with the operations at consumer banking general remaining strong despite economic uncertainties currently bedeviling the market.

Also Read: How to Buy Crypto with DBS Bank?

Market Situation

Current market conditions have been favorable for the JPMorgan stock forecast, even though there’s been some volatility. Higher interest rates actually boost net interest margins, and the bank’s trading revenues remain strong amid the market volatility that traders are dealing with right now.

The DBS investment outlook considers JPMorgan’s operational efficiency along with risk management capabilities that have been proven. This high price target is borne out by the good performance of the bank in various areas of business, as well as the good rates it pays to shareholders which have remained constant.

Also Read: DBS: Singapore’s Largest Bank Launches Blockchain-Based Banking

DBS analysts adjusted the JPMorgan price target to $290, and this represents strong upside potential based on current levels. The analysts believe that the bank will sail smoothly in the present economic climate as well as produce good financial performance which is in need by investors today.