High-growth stocks present some really attractive opportunities for investors with about $1,000 to deploy right now in the market. Even though the beginning of 2025 has been quite challenging, with major indexes like the S&P 500 and Nasdaq finding themselves in negative territory, there are still several promising investment options that have emerged for those looking to make smart stock market investments with their hard-earned cash.

Also Read: De-dollarization and the Digital Currency Battle: Why Gold-Backed Stablecoins Could Replace the USD

Top Stocks for Smart Investors: Maximize Returns This Week

The current market downturn has, in fact, created some pretty good buying opportunities for investors who are paying attention. If you happen to have around $1,000 ready to invest at this moment, you might want to consider these high-growth stocks that seem particularly well-positioned.

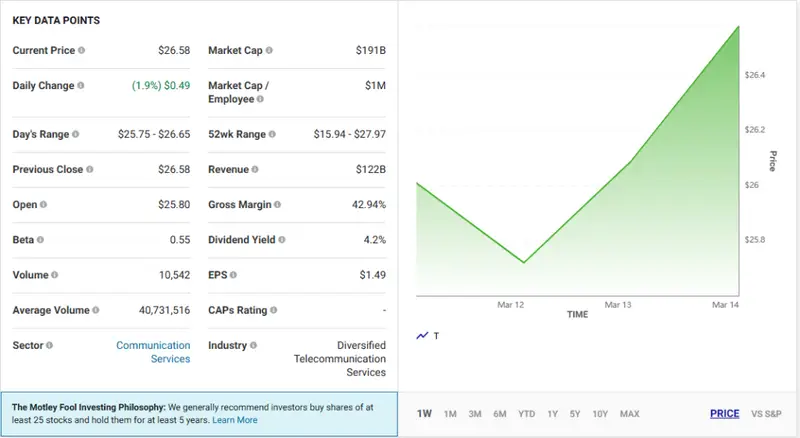

1. AT&T’s Remarkable Turnaround

AT&T has been defying the overall 2025 market slump with its shares up over 18% since January, and also continuing the momentum that has already driven a very impressive 56% increase over the past twelve months. The telecom giant’s renewed focus on its core services has definitely yielded some impressive results.

The company managed to add about 1.7 million postpaid phone customers and also 1 million fiber customers in 2024, which marks seven consecutive years of really strong fiber growth. This high-growth stock also offers a pretty compelling dividend yield of approximately 4.1% at the time of writing.

Also Read: Binance Declares 0% Trading Fees on Wallet Until September 2025

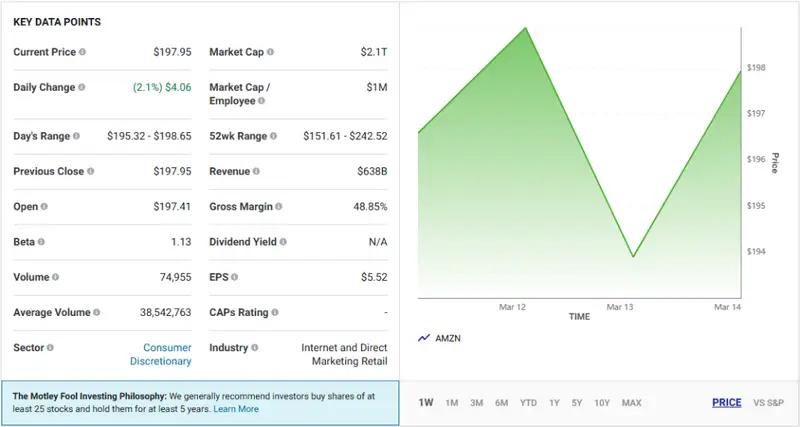

2. Amazon’s Diverse Growth Potential

Even though Amazon is down about 12% this year so far, it remains a solid high-growth stock with very strong fundamentals. The company’s evolution from an online retailer to a diverse ecosystem that spans cloud computing, advertising, and entertainment positions it quite well for continued expansion in the coming years.

Amazon Web Services currently drives about 58% of the company’s operating income despite generating less overall revenue than the e-commerce division. In 2024, Amazon’s total revenue reached an impressive $638 billion, which marked an 11% year-over-year increase.

Also Read: Time To Exit Stocks? New Gold Prediction Claims XAU To Hit $4000

3. Airbnb’s Expansion Strategy

Airbnb represents another really compelling high-growth stock with significant potential for the future. The company achieved approximately 12% revenue growth in 2024, with around 491 million nights and experiences booked through their platform.

The management team currently plans to launch at least one new service annually over the next five years to increase user engagement. And with most users currently using the platform just once or twice yearly, there are substantial growth opportunities that still exist.

Wall Street analysts project:

Earnings to grow at an annualized rate of 14% over the long term.

For investors who are seeking the best stocks to buy now, these high-growth stocks offer some diverse options. AT&T provides stability and income, while Amazon and Airbnb present greater growth potential over time.

Also Read: Pi Coin Set for 50% Surge: Coinbase Listing Rumors Ignite Investor Interest