The cryptocurrency market is facing another significant crash today, with Bitcoin (BTC) falling below the $99,000 price level. This is the third instance of Bitcoin (BTC) falling below the $100,000 mark in November 2025. According to CoinGlass data, the crypto market saw more than $1 billion worth of liquidations in the last 24 hours. Despite bullish developments, the crypto market is struggling to gain momentum. Let’s discuss why the market is down today, and if it will recover soon.

Why Did The Cryptocurrency Market Crash Again?

The cryptocurrency market began its downward trajectory over a month ago. Many believed the US government shutdown may have caused increased investor worry. However, the market has failed to positively react to the end of the government shutdown.

Moreover, financial institutions have offloaded significant amounts of cryptocurrency assets from their ETF vehicles. ETFs have played a vital role in the current market cycle. Increased outflows have led to substantial price corrections.

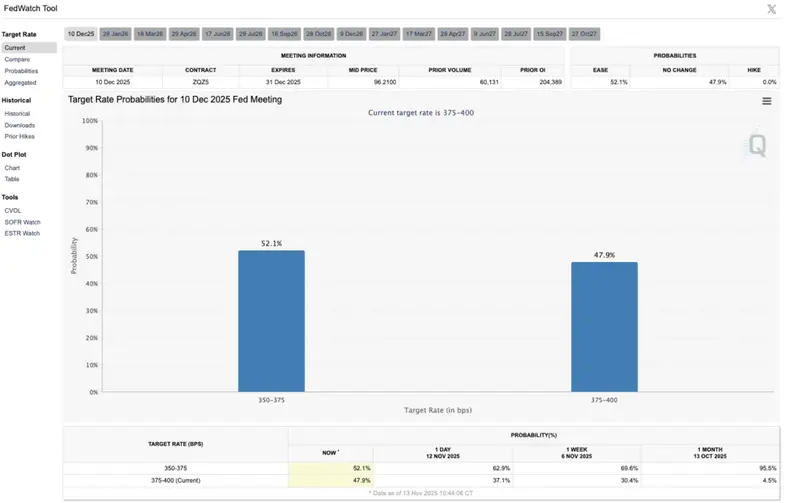

Moreover, the Federal Reserve announced another 25 basis point interest rate cut in October. The rate cut was still not enough to push the cryptocurrency market. The ongoing market correction is likely due to the diminishing chances of another interest rate cut in December. According to CME FedWatch, there is a 52.1% chance of a 25 basis point interest rate cut in December, and a 47.9% chance that rates will remain unchanged.

Not just the cryptocurrency market, but other risky assets have also faced price dips. Nasdaq and the S&P 500 are also facing liquidations.

Also Read: Strategy (MSTR): Saylor Says Bitcoin Will be Bigger Than Gold

There is a chance that the market will recover as many may begin to buy the dip. Cryptocurrency ETF inflows may also pick up steam over the coming weeks. Although another interest rate cut may not happen in 2025, investors could begin to stock up on crypto assets over this month, given that prices are low.