The US markets are encountering a paradoxical wave of events where, on one hand, the Clarity Act bill is about to take center stage, and on the other hand, a negative Supreme Court tariff ruling could perplex markets for the long term. Trump is embroiled in a mix of chaotic events, awaiting a Supreme Court ruling on his yearlong tariff regimen. If the court reverses Trump’s tariff ordeals, this could result in the US issuing billions worth of refunds, shocking the global markets in an intense way.

Also Read: Goldman Sachs Sees Global Stocks Gaining 11% Over Next 12 Months

Trump’s Tariffs and Supreme Court Ordeals: What Is Happening?

Donald Trump, the US president, has recently issued a statement regarding his upcoming tariff ruling by the Supreme Court. This hearing is essential for the future of the United States, as it may rule out the legitimacy of tariffs imposed by the US on other countries. However, a negative ruling reprimanding these tariffs can be intense for markets, as the US may be compelled to shell out billions as tariff refunds, sending shockwaves within the market anatomy.

Trump made new comments about this ruling recently, adding how the entire payback process could be extremely messy for the nation to deal with if this ruling goes awry in any way.

“The actual numbers that we would have to pay back if, for any reason. The Supreme Court were to rule against the United States of America on tariffs would be many hundreds of billions of dollars, and that doesn’t include the amount of ‘payback’ that countries and companies would require for the investments they are making on building plants, factories, and equipment for the purpose of being able to avoid the payment of tariffs. When these investments are added, we are talking about trillions of dollars! It would be a complete mess and almost impossible for our country to pay.”

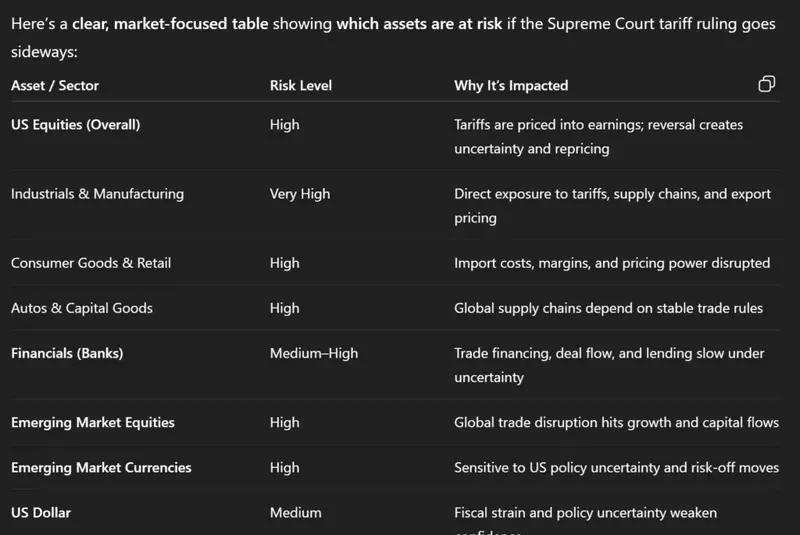

Assets at Risk

Trump later shared how this development could push the US off track, compelling it to pay an exorbitant amount of money.

“Anybody who says that it can be quickly and easily done would be making a false. Inaccurate, or totally misunderstood answer to this very large and complex question. It may not be possible. But if it were. It would be dollars that would be so large that it would take many years to figure out what number we are talking about and even who, when. And where to pay.” Trump later shared

If this ruling goes sideways, the assets that are most at risk are US equities and emerging market assets, per ChatGPT. Moreover, the US dollar and commodities linked to global growth are also at risk, given their volatile nature and stance.

Also Read: Why Morgan Stanley Is Bullish on the Chinese Yuan for Q1 2026