Happy Gilmore 2 is generating massive buzz among streaming audiences and investors alike, as this highly anticipated Adam Sandler sequel could potentially drive NFLX stock toward its ambitious $1,600 price target. When does Happy Gilmore 2 come out? The movie releases on Netflix February 25, 2025. The film will stream exclusively on the platform, with Netflix subscription options starting at $7.99/month for viewers eager to catch Sandler’s return to the golf course. Is Happy Gilmore 2 only on Netflix? Yes, it’s a Netflix exclusive, and this strategic Gilmore 2 release time represents a significant move that could impact the NFLX stock price target expectations during a critical market period for the streaming giant.

When Does Happy Gilmore 2 Come Out, & Can NFLX Reach $1,600 Target?

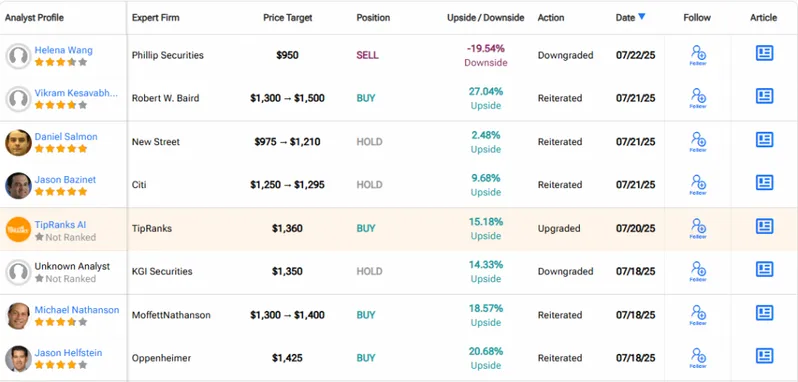

Right now, multiple analysts have been setting pretty bullish targets for Netflix stock, and the Happy Gilmore 2 release is being viewed as a potential catalyst for growth. TipRanks AI shows a $1,360 price target, while other firms are actually pushing toward the $1,600 NFLX stock price target. The release date for the movie could hit for maximum impact? Well, the February 25th date positions Netflix perfectly for Q1 metrics, along with subscriber growth expectations.

Happy Gilmore 2 Market Impact Analysis

Based on 38 Wall Street analysts, Netflix shows strong upside potential with the highest price target reaching $1,600. At the time of writing, the Happy Gilmore 2 release time coincides with Netflix’s broader content strategy to maintain market leadership. Is Happy Gilmore 2 on Netflix exclusively? Yes, and this exclusivity is being used to support the bullish NFLX stock price target outlook among financial experts.

Also Read: Netflix Stock (NFLX) Soars 86% But 44x Earnings Ratio Sparks Risk

Happy Gilmore 2 Revenue Projections

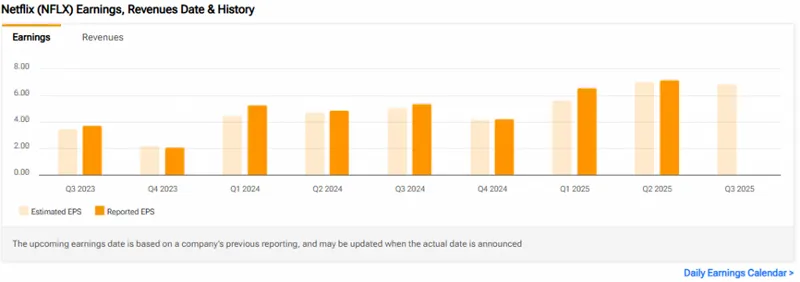

Netflix’s stock performance has been outpacing broader markets, and Happy Gilmore 2 is expected to drive even more subscriber acquisition. The streaming giant’s revenue growth of 14.28% and EPS growth of 46.86% are being used by analysts to support their confidence in reaching the $1,600 target.

The company’s earnings trajectory has been consistently strong, with quarterly results showing steady growth patterns that are supporting analyst optimism.

The sequel brings back Sandler’s iconic golf character, which actually represents significant value for Netflix’s content portfolio. The movie leverages the platform’s exclusive content strategy to justify those premium valuation targets that Wall Street has been setting.

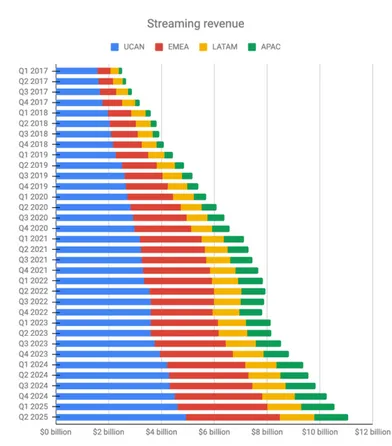

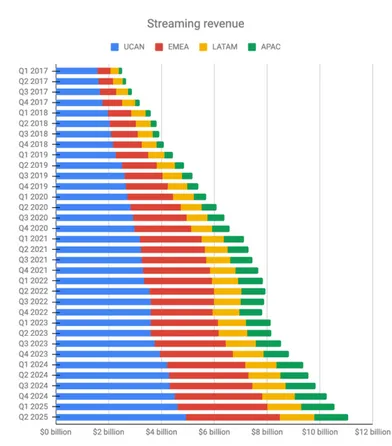

Global streaming revenue continues growing across all regions, with Happy Gilmore 2 positioned to strengthen Netflix’s position in key markets.

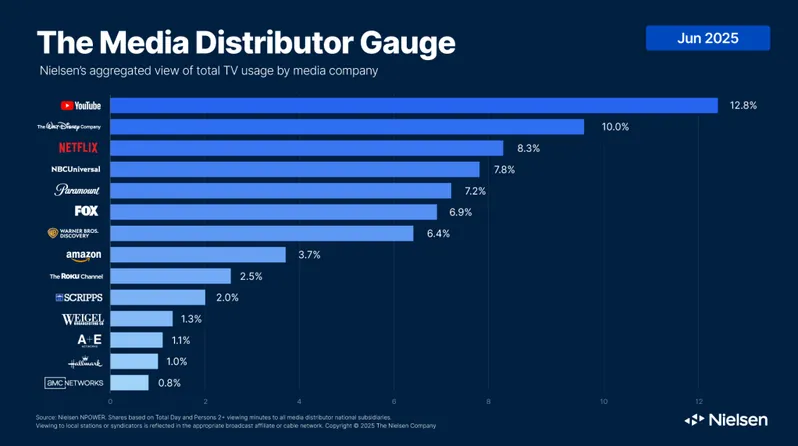

Netflix maintains 8.3% of total TV viewership, and the movie is positioned to strengthen this market position along with supporting the journey toward the $1,600 NFLX stock price target that analysts have been eyeing.

Also Read: Netflix (NFLX) Stock Hits Another Record: Jeffries Sets Higher Mark

The February 25th premiere date for Happy Gilmore 2 represents more than just entertainment—it’s a strategic content play that could help Netflix reach those ambitious stock price targets that Wall Street has been setting.