Magnificent 7 stocks have, at the time of writing, reached their lowest valuation levels in seven years according to Goldman Sachs. Tech giants including Nvidia stock and also TSLA face mounting pressure right now amid AI investment concerns, as well as trade policy risks, and even antitrust litigation. AAPL and other such tech leaders trading on Nasdaq: NVDA continue to experience valuation compression in these early months of 2025.

Also Read: $1,000 in Shiba Inu & XRP: Which Will Give Better Returns in 2030?

Magnificent 7 Stocks Face Pressure from AI, Trade, and Litigation

Record Low Valuations Reported

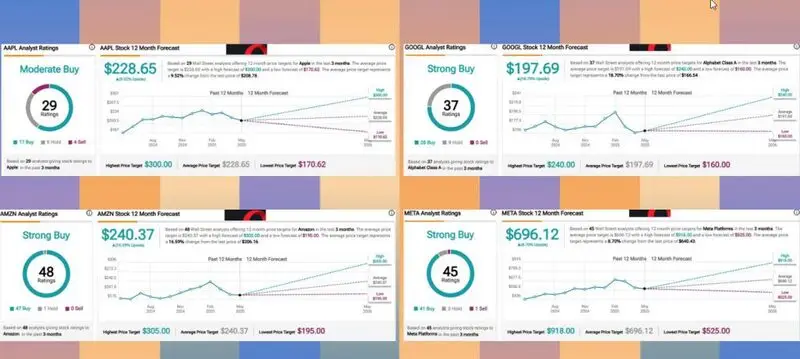

The Magnificent 7 stocks are, at present, trading at their cheapest levels relative to the broader market in about seven years or so. Goldman Sachs strategist David Kostin actually highlighted that these tech companies now show an aggregate forward price-to-earnings ratio of around 28, compared to maybe 20 for the remainder of the S&P 500.

David Kostin stated:

“Concerns regarding AI investment, trade policy risk, and government antitrust litigation have compressed the valuations of the Magnificent 7 stocks.”

Also Read: Binance Is Teasing Pi Coin Exchange Listing: This Viral Post Shows It’s Happening

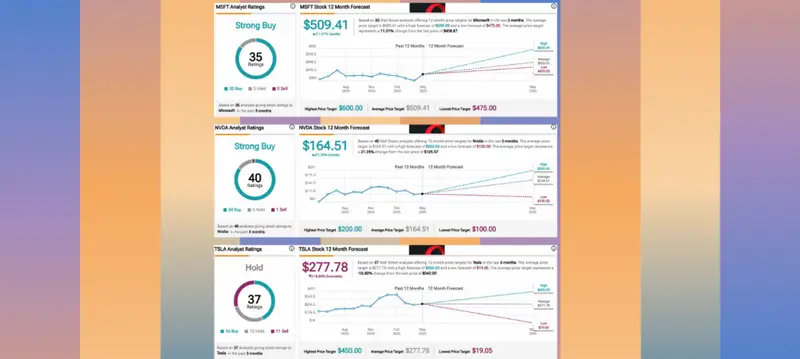

Contrasting Fortunes Within MAG7

Shares of Nvidia have a strong upward trajectory, as supported by many analysts suggesting a buy, but analysts suggest a more wait-and-see approach for Tesla. Since stocks in the Magnificent 7 were judged differently by Goldman, it seems that there are major differences in how each is performing at the moment.

Potential Recovery Catalysts

Despite the current pressure, Goldman Sachs believes that upcoming earnings reports could possibly provide some relief for the struggling Magnificent 7 stocks. Nasdaq: NVDA remains somewhat positioned at the forefront of the AI hardware market, while AAPL continues to try and navigate through the complicated trade tensions.

Goldman Sachs noted:

“Q1 earnings could provide an AI boost for the seven.”

Also Read: DigiAsia Unveils $100M Bitcoin Plan, FAAS Stock Surges 91% on Bold Bet

The valuation compression may perhaps represent a cyclical adjustment rather than a fundamental shift for these industry leaders. The aggregate forward P/E ratio, while still indicating a premium, has definitely narrowed considerably from previous levels, potentially creating what some analysts kind of view as a buying opportunity for Magnificent 7 stocks in the near term.