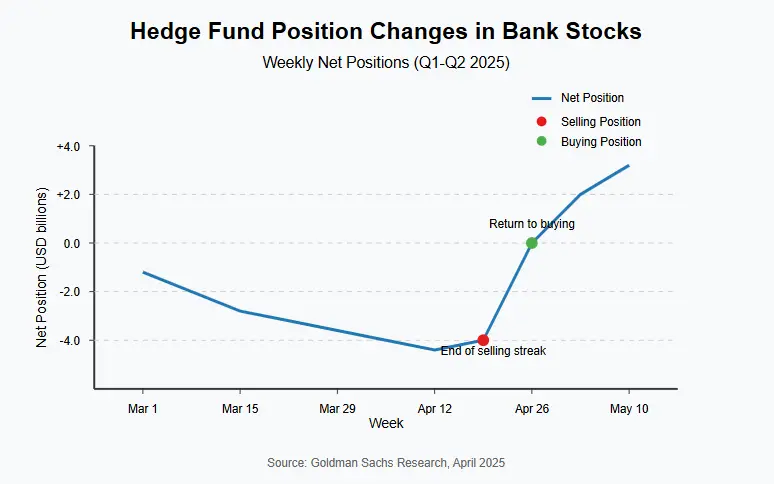

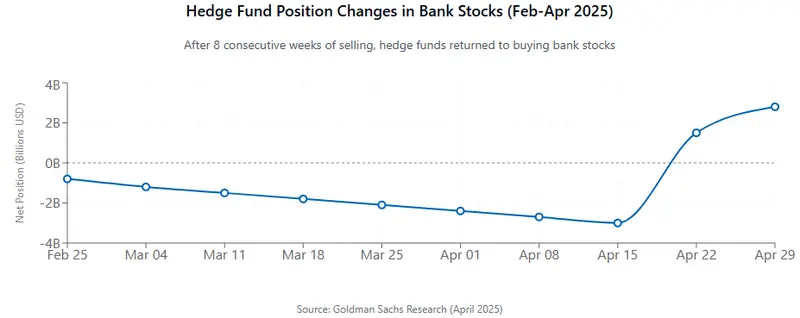

Hedge funds stock move patterns have shifted dramatically as these investors return to markets to buy bank shares after eight straight weeks of selling, according to Goldman Sachs. This unexpected change in hedge fund strategies has positioned financial firms, including U.S. banks, as the second-most net bought stock behind real estate this year, signaling significant market volatility ahead.

Also Read: De-Dollarization: 5 Oil Giants Now Settling in Yuan, Not USD

What Hedge Funds’ Shift Means for Banks and Markets

The sudden hedge funds stock move comes as markets process first-quarter earnings reports from major U.S. banking institutions. Goldman Sachs revealed this shift in a note released last Friday, which was later seen by Reuters.

Goldman Sachs stated: “Hedge fund positions in financials as an overall stock sector reached a two-year high.”

Record Trading Performance Attracts Investment

Major banks achieved spectacular success in their trading units during the latest period. During the market boom of the early year JPMorgan Chase and Morgan Stanley generated their highest revenue while Wells Fargo collected more fees from clients. The encouraging financial outcomes seem to drive hedge fund investments into banking institutions in recent times.

Also Read: Shiba Inu’s Future If Bitcoin Soars to $2.4M: SHIB Holders Won’t Believe This

Long Positions Dominate Bank Shares Strategy

The Goldman Sachs analysis shows hedge funds have taken mostly long positions on financial stocks for five of the last seven weeks. This type of buying has outpaced hedge fund trades resulting from exiting short bets, demonstrating genuine confidence in bank shares amid ongoing market volatility.

Performance Gains Follow Strategic Shift

The recent hedge funds stock move is already showing positive results. According to the Goldman Sachs note:

“Global stock picking hedge fund performance rose over 2% between April 18 and 24, and systematic traders posted a 0.44% performance increase during the same time period.”

While capital markets firms and banks dominated last week’s purchases, financial services firms that facilitate trading were the most bought financial stock category this year, highlighting the nuanced approach hedge fund strategies are taking in the current market.

Also Read: Top 3 Cryptocurrencies That Could Hit New All-Time Highs In 2025