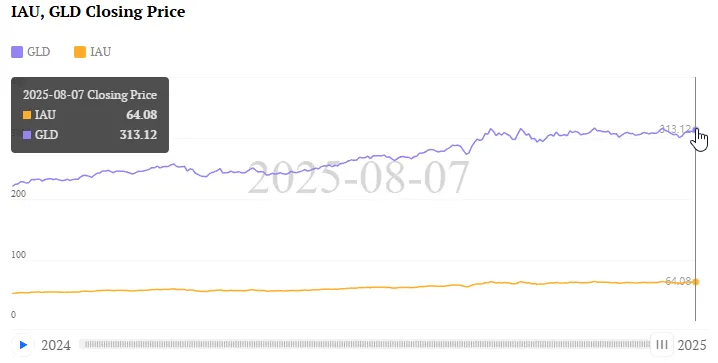

Gold’s price record rally has actually been hitting some pretty impressive levels right now, reaching $3,401 per ounce and marking an stunning 39% annual gain as Trump Fed appointment of Stephen Miran is basically reshaping Federal Reserve board expectations. This gold price record rally reflects geopolitical uncertainty along with gold investment strategy shifts amid monetary policy changes happening at the time of writing.

Gold Price Record Rally Fueled by Geopolitical Uncertainty and Trump Fed Appointment

The Trump Fed appointment of economist Stephen Miran to the Federal Reserve board is actually intensifying the ongoing gold price record rally that we’re seeing. Miran’s crypto-friendly stance and also his policy views signal some shifts supporting gold investment strategy positioning right now.

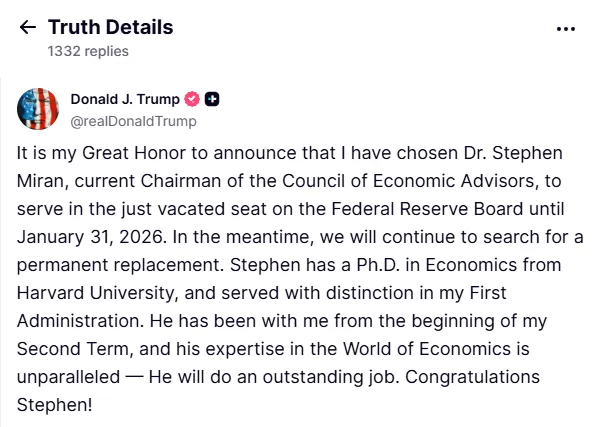

Trump stated:

“It is my Great Honor to announce that I have chosen Dr. Stephen Miran, current Chairman of the Council of Economic Advisors, to serve in the just vacated seat on the Federal Reserve Board until January 31, 2026.”

Central bank demand is underpinning this gold price record rally, with institutions purchasing over 1,000 metric tons in 2024. This systematic buying actually reflects geopolitical uncertainty and even de-dollarization trends from various countries.

Also Read: Banks Choose Gold Over Bitcoin & USD—Here’s Why

The Trump Fed appointment strategy extends beyond just Miran as Federal Reserve board restructuring creates some optimal conditions for gold investment strategy positioning amid ongoing geopolitical uncertainty.

Quotes From Officials & Gold Futures

Senate Banking Committee Chairman Tim Scott stated:

“I look forward to quickly considering his nomination in the Senate Banking Committee and hearing more about his plans to increase transparency and accountability at the Federal Reserve.”

Elizabeth Warren said she would have:

“tough questions for him during his confirmation hearing about whether he’d serve the American people as an independent voice at the Fed or merely serve Donald Trump.”

Fed Chair Jerome Powell expressed concerns about policy challenges:

“Tariffs are highly likely to generate at least a temporary rise in inflation. The inflationary effects could also be more persistent.”

Miran had this to say about tariff concerns:

“Rare events happen. We get pandemics or, or meteors or whatever. There’s just no evidence thus far of it happening.”

Also Read: AI Predicts Price Of Bitcoin, ETH If Trump’s Select A New Fed Chair

Goldman Sachs projects gold reaching $3,700 by end-2025. The convergence of Trump Fed appointment decisions along with persistent geopolitical uncertainty creates sustained gold investment strategy momentum through 2026.