Five nations control over half of the world’s official gold reserves in 2025, and this concentration is reshaping global finance right now. The United States leads with 8,133.5 metric tons, followed by Germany with 3,351.5 tons, Italy with 2,451.8 tons, France with 2,437.0 tons, and Russia with 2,335.9 tons.

In total, these nations together own roughly 18,706.2 metric tons out of the current estimated total reserves of 35,938.6. Central banks purchased more than 1,000 metric tons in 2024, and this excessive buying is spurring the trend away from the dollar.

Also Read: De-Dollarization Surge: 70+ Countries Abandoning the US Dollar

How These Gold Reserves Reshape Global Trade in 2025 & Challenge US Dominance

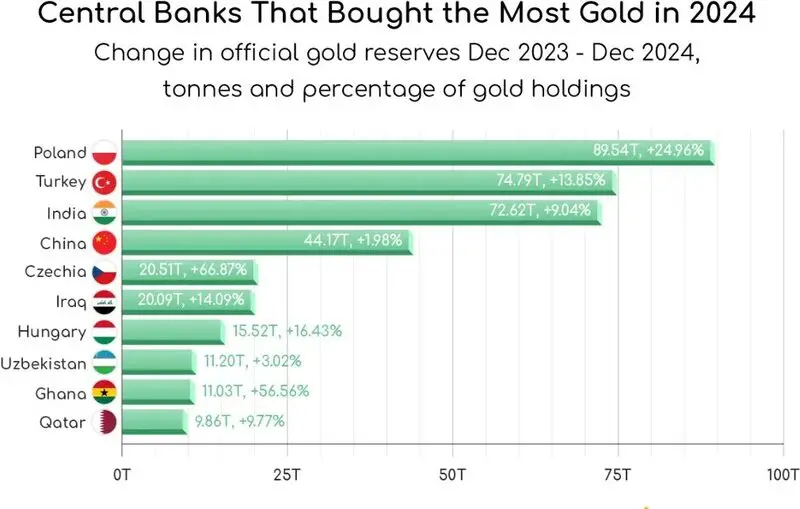

The landscape today looks different because of the massive amount of assets that central banks worldwide have purchased. Poland purchased a record amount of 3.24% of the world’s gold in 2024 and this huge rise moved Poland up into the ranks of significant gold buyers.

Turkey managed to accumulate 74.79 metric tons last week, after facing strong selling pressure earlier due to currency crises. India added 72.62 metric tons this month and China maintained the regular accumulation it started in late 2022.

The Big Five’s Stranglehold on Global Control

Nearly three-quarters of the United States’ total foreign exchange reserves are made up of bullion. The New York Fed and Fort Knox mostly hold a large reserve of greenbacks dating from when nations could swap their dollars for US assets during the Bretton Woods era.

Much of the German holdings come from accumulated surpluses spent after the war and from the sale of German assets around the world. The Bundesbank arranged to move large amounts of gold from the US and France to banking vaults in Frankfurt, so it held these treasures itself. Bullion accounts for 70.6% of Germany’s total reserves, indicating trust in gold that goes back many years.

Around 67.5% of Italy’s reserves consist of holdings managed by the Banca d’Italia and despite a few political discussions about selling them to shrink the country’s debt, they have been held on to provide stability. France possesses 2,437.0 metric tons of its gold, with 68.6% of its total, as a result of the fund exchange standoff led by President de Gaulle.

Russia rounds out the top gold holders in 2025 with significant tonnage, representing a quadrupling since 2008 as the Kremlin systematically reduced dollar exposure. While the metal represents only 28.1% of Russia’s total reserves, this strategy proved prescient when Western sanctions froze other Russian foreign assets.

Central Bank Buying Frenzy Continues Worldwide

To stop inflation and protect against geopolitical challenges, banks everywhere are turning to precious metals. The World Gold Council announced that 2024 saw gold purchases of over 1,000 tons, continuing a streak of record buying.

China’s approach to strategy reflects emerging market changes away from standard approaches. As Central Bank of China owns $3 trillion in total foreign reserve, but just 2,279.6 metric tons dollars or 4.6% to its entire portfolio, its monthly purchases since late 2022, imply it will soon not rely on dollar assets as much. These purchases also follow wider global gold dominance trends because emerging markets add these assets to their reserves because they are “sanction-proof.”

Also Read: 80% of Americans Want Bitcoin in National Reserves Over Gold

Smaller nations also joined the accumulation race. Czechia added 20.5 metric tons, which represents a 66.87% increase, while Iraq purchased 20.09 metric tons.

This buying surge occurs against persistent inflation concerns and currency instability worldwide. The metal’s role as a hedge against monetary debasement has been reinforced by recent economic turbulence, making it attractive to central banks seeking portfolio diversification beyond traditional government bonds.

The data shows Switzerland leads global exports at $116 billion, while the UK handles $66 billion and Hong Kong manages $57 billion. Meanwhile, China dominates imports at $103 billion and India follows with $52 billion. This pattern highlights the physical movement of precious metals toward emerging economies building strategic reserves.

Gold Reserves in 2025 Put Dollar Dominance Under Serious Pressure

The growing instability of global politics has increased what analysts refer to as the US dollar challenge, because states now see the usefulness of holding hard assets to protect their financial position. Several countries are trying to escape relying on the dollar in trade by using different systems that aren’t easily disturbed by sanctions.

Also Read: JPMorgan: Bitcoin Likely to Outperform Gold in 2nd Half of 2025

The figure suggests this de-dollarization trend will increase, mostly due to emerging countries putting more effort into stockpiling reserves to prevent problems with their currency and politics. It isn’t doubtful that this concentration will prevail in gold holdings; rather, how these holders may reshape the world’s trade and currency arrangements in 2025 is the question.