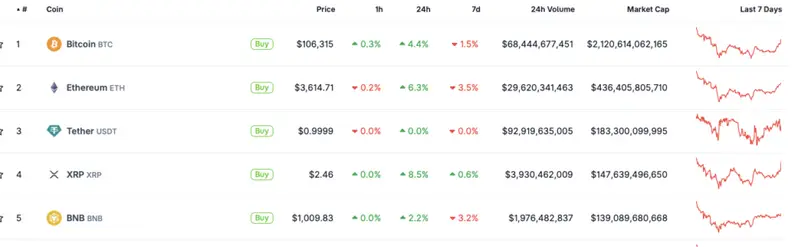

The crypto market seems to be entering a recovery phase after the recent downtrend. Bitcoin (BTC) has reclaimed the $016,000 price level, rallying 4.4% in the last 24 hours, according to CoinGecko data. The global crypto market cap has risen 4.5% in the last 24 hours to $3.68 trillion. While many assets are still trading in the red zone in the weekly charts, we may be entering the early stages of another bull run. Let’s discuss why the crypto market is rallying today, and if it will continue.

What’s Behind The Crypto Market Recovery?

The latest market rally could be due to the US government shutdown nearing its end. The US faced its longest government shutdown in history, leading to detrimental effects on the crypto market. President Trump also reiterated that the shutdown will end very soon.

With the Federal Reserve rolling out another interest rate cut after its October meeting, and the US government shutdown coming to an end, we could be entering another bullish phase for the cryptocurrency market.

Also Read: Trump Hints at Crypto For US Debt Pay Off: What Will Happen?

The ongoing crypto market recovery depends heavily on Bitcoin’s (BTC) trajectory. If BTC maintains its upswing, other assets will likely follow its trajectory. According to CoinCodex analysts, BTC will hit new highs over the coming weeks. The platform anticipates the original cryptocurrency to hit a new all-time high of $142,263 on Dec. 25, 2025. Hitting $142,263 from current price levels will translate to a rally of about 33.8%.

However, there is also a possibility that the crypto market will not sustain its ongoing recovery. Global markets are still quite fragile, and macroeconomic conditions could present challenges. Federal Reserve Chair Jerome Powell warned about slow economic growth and rising inflation after the Fed’s October meeting. These challenges could seep into the crypto market, leading to fresh volatility.