Fidelity SEC filing blockchain funds is making quite a stir in financial circles as the asset management giant recently submitted a proposal to the Securities and Exchange Commission. At press time, Fidelity asks for regulatory approval to launch a blockchain-based version of its U.S. dollar money market fund.

Also Read: JBM Auto Shares Rise 17% Today: Spike 20 Trading Sessions Put Together

How Fidelity’s SEC Filing Could Revolutionize Blockchain-Based Dollar Funds

The Fidelity SEC filing blockchain funds paperwork shows that the company, which manages around $5.8 trillion in assets, wants to register an “OnChain” share class of its Fidelity Treasury Digital Fund (FYHXX). This fund currently uses the Ethereum network and might expand to other blockchains down the road. If everything goes as planned and the regulators give their approval, this blockchain-based fund could be up and running by May 30.

Major Financial Players Entering the Space

This isn’t really happening in isolation. It’s actually following a path that was pioneered by Franklin Templeton, who launched the first on-chain money market fund back in 2021. And then JPMorgan also joined in around 2023 with their own tokenized U.S. Treasury bond fund, and BlackRock, partnered with Securitize to launch their BUIDL tokenized U.S. Treasury bill fund in March 2024.

Market Growth and Adoption

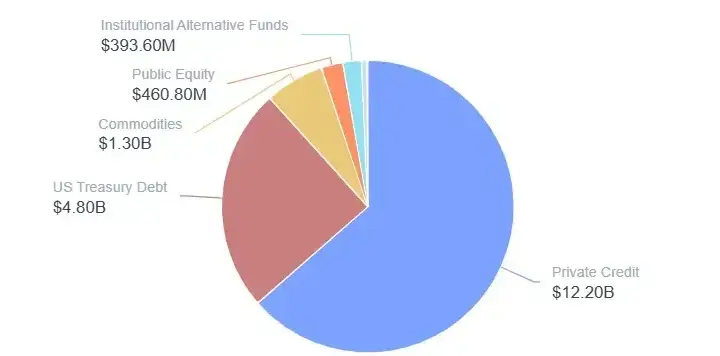

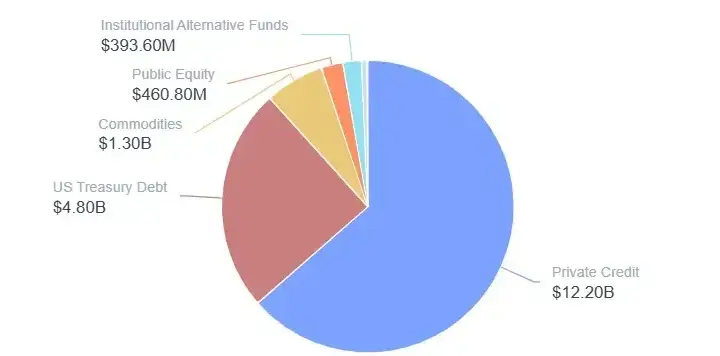

According to the latest data, Tokenized U.S. Treasury debt has become the second-largest type of tokenized real-world asset with a market cap of about $4.80 billion. The whole tokenized U.S. Treasury market has grown by almost 500% just in the last year, which shows how people are adopting blockchain-based funds despite all the cryptocurrency market volatility we keep hearing about.

Also Read: Michael Saylor’s Strategy Buys Another $584M in Bitcoin

Regulatory Considerations

The SEC filing cryptocurrency process is definitely a really important step for all these tokenized money market funds that want to operate within the regulated financial space. Fidelity getting involved like this just shows how there’s growing institutional interest in bringing traditional financial products onto blockchain systems, which people often call the tokenization of real-world assets.

Fidelity’s Digital Asset Strategy

The Fidelity SEC filing blockchain funds initiative is expanding on the company’s existing presence in digital assets. Fidelity is already one of the largest issuers of spot Bitcoin and ether exchange-traded funds in the U.S., and their FBTC and FETH funds hold approximately $16.5 billion and $780 million in assets respectively.

This move into tokenized money market funds is basically another step in Fidelity’s broader strategy to kind of bridge traditional finance with blockchain technology, which might help address issues like cryptocurrency market volatility through more stable financial products and such.

Future Implications

As more and more major financial institutions launch SEC filing cryptocurrency initiatives, these blockchain-based funds are becoming more mainstream every day. The tokenized money market funds sector continues to grow as big institutional players start to recognize the potential efficiency gains and operational benefits that blockchain technology can provide.

Also Read: US Dollar: April 2nd May Turn Into A Global Crisis Day: Here’s How

If approved, Fidelity’s blockchain initiative would further legitimize the use of distributed ledger technology in traditional finance, and might even open the door for more innovative blockchain-based funds in the future.