Trump’s 401K crypto policy changes are actually revolutionizing American retirement investing by opening up the $9 trillion 401k market to Bitcoin and also alternative assets. This Trump’s 401K crypto policy shift enables crypto retirement investing while also expanding gold IRA strategy options and private equity access through comprehensive US 401K reform right now.

Trump plans to open Bitcoin access to American pensions, unlocking a $9 trillion pool of capital. Just 1% = $90 billion.

— Decentra Suze (@DecentraSuze) July 18, 2025

Then when you look at global AUM which is around $115 trillion you start to see the scale of where this could go.

Larry Fink said that 2–5% allocations from… pic.twitter.com/TyxFYf5Dj5

Trump’s 401k Crypto Policy Signals Retirement Shakeup With Gold, Equity

Trump’s 401K crypto policy represents a pretty major shift in retirement planning, and it’s unlocking access to a $9 trillion capital pool that was previously restricted to traditional investments and more conservative assets. This crypto retirement investing framework allows American pensions direct Bitcoin access, creating substantial market opportunities along with some significant changes happening across the board.

$90 Billion Bitcoin Allocation Potential

Under the new Trump’s 401K crypto policy, American workers can now allocate retirement funds to Bitcoin directly and also to other digital assets. Even a modest 1% allocation from the $9 trillion pension market translates to approximately $90 billion in potential Bitcoin investment, which is actually quite substantial when you think about it and consider the broader implications.

DecentraSuze stated:

“Trump plans to open Bitcoin access to American pensions, unlocking a $9 trillion pool of capital. Just 1% = $90 billion.”

The scale becomes even more impressive when you consider that global assets under management are being looked at by institutions seeking crypto retirement investing opportunities and also exploring new investment avenues that were previously off-limits.

Also Read: 401k vs 403b: What’s the Difference?

Global Investment Flows Drive Crypto Retirement Investing

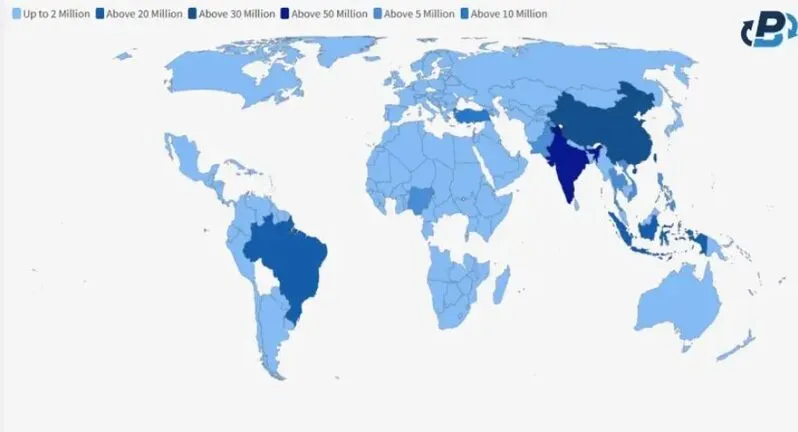

The ripple effects extend beyond US borders, with global assets under management reaching around $115 trillion and growing. Trump’s 401K crypto policy change validates institutional crypto retirement investing strategies while encouraging gold IRA strategy adoption and private equity access expansion at the same time.

DecentraSuze noted:

“Then when you look at global AUM which is around $115 trillion you start to see the scale of where this could go.”

Analysts who track institutional money flows right now are watching these numbers closely, and financial sector professionals along with pension fund managers are discussing the implications.

Institutional Momentum Behind US 401K Reform

The proposed US 401K reform addresses longstanding restrictions on alternative investments that have been in place for years and also limits that prevented broader asset diversification. Larry Fink’s observations about sovereign fund allocations support Trump’s 401K crypto policy direction, suggesting 2-5% institutional allocations could drive significant price appreciation right now.

DecentraSuze highlighted:

“LarryFink said that 2-5% allocations from sovereign and institutional funds could potentially push Bitcoin to $500k.”

This momentum is spreading across the financial industry as firms prepare for potential changes and also adapt to new regulatory frameworks that are emerging.

Market Access and Implementation

This comprehensive approach to crypto retirement investing and gold IRA strategy implementation creates unprecedented opportunities that weren’t available before and also opens doors to alternative investments. Trump’s 401K crypto policy ensures broader private equity access while maintaining regulatory oversight through structured US 401K reform measures that officials are implementing gradually over time.

DecentraSuze observed:

“Everything’s bleeding into Bitcoin: pensions, ETFs, corporates, even countries.”

Also Read: Coinbase CEO Says US Debt Will Cause Bitcoin to Overtake the Dollar

The implementation timeline remains fluid, but market participants are already positioning for these transformative changes in retirement investing infrastructure at the time of writing, and the process is expected to unfold over the coming months and years ahead.