According to Token Terminal data, Ethereum (ETH) staking has climbed to a new all-time high. The project now has 36.8 million coins locked, worth around $74.3 billion. Moreover, Ethereum has nearly 1 million validators securing the network. ETH’s staking ratio has also climbed to a new peak, surpassing 30% of the total supply. Let’s discuss whether staking hitting a new peak will push Ethereum’s (ETH) price north.

Will Ethereum Rally After Staking Hit An All-Time High?

While the high staking figures increase confidence in the Ethereum network’s security, they may not directly lead to a price rally. Staking implies that investors are bullish on the Ethereum network’s performance, and want to participate as a network validator. However, prices will likely not recover just yet.

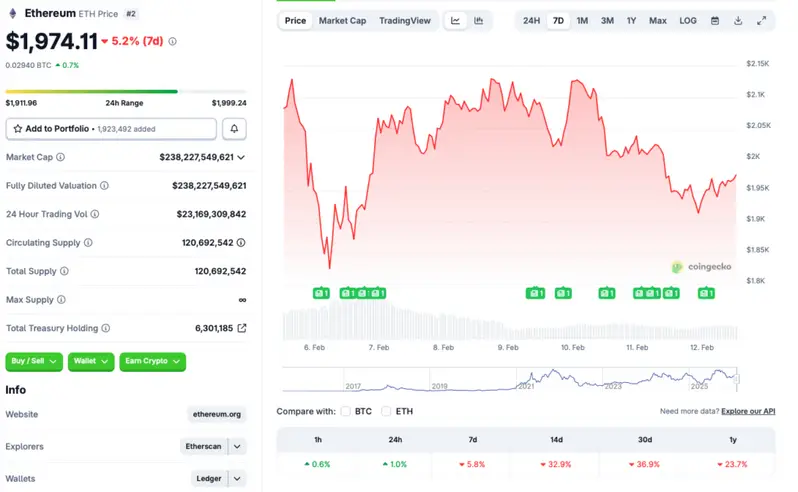

Ethereum’s (ETH) price has struggled to gain momentum over the last few months. The asset’s price climbed to an all-time high of $4,946.05 in August if last year, but has since dipped by more than 60%. According to CoinGecko data, ETH’s price is down 5.8% in the last week, 32.9% in the 14-day charts, and nearly 37% over the previous month.

Ethereum’s (ETH) price correction came after macroeconomic worries and geopolitical tensions gripped investors late last year. The market took another dip after a liquidity crunch in 2026. The developments have led to a substantial exodus of investors from the crypto market. Market participants have been taking a risk-averse approach over the last few months, evident from gold and silver’s rise.

Also Read: Ethereum Price Hits Below $2K: How Low Can ETH Crash In This Cycle?

Ethereum (ETH) will likely follow Bitcoin’s (BTC) trajectory, which seems to have found some footing at the $67,000 price level. BTC is down to its 2021 all-time high price levels, and could face further corrections over the coming weeks. Stifel anticipates BTC to dip to the $38,000 price level. BTC hitting $38,000 could lead to Ethereum (ETH) facing a massive price dip.