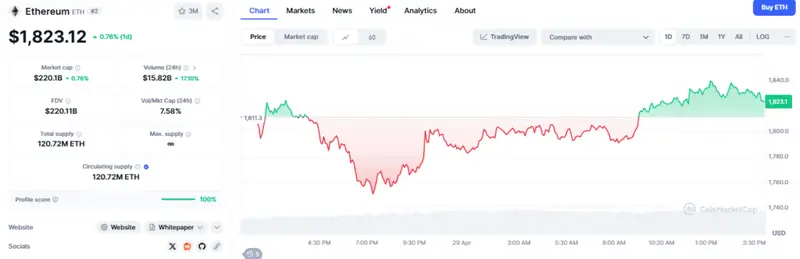

The severe Ethereum price drop of 47% in 2025 has many investors questioning whether now is actually the time to buy or sell. At the time of writing, ETH is trading at around $1,823.12 with a slight 0.83% recovery over the past day, and Ethereum faces significant challenges despite its rather substantial $220.49 billion market cap.

Also Read: Top 5 Defense Stocks to Buy as U.S. Approves $150B Military Budget

Ethereum Price Drop Risks and Market Uncertainty: Should You Invest Now?

Declining Active Wallets Signal Trouble

Recent data shows Ethereum’s active wallet addresses dropped to about 13.9 million in March, down 1.5 million from last year. This key metric suggests users are moving away from the network despite its well-established position.

Alex Carchidi, crypto analyst, was clear about the fact that:

“Ethereum is the second-largest cryptocurrency, with a market cap of almost $220 billion. That means that if its ecosystem is healthy, there should be a vast number of users interacting with its chain via crypto wallets.”

At present competitors have stronger user involvement than NanoX. The cryptocurrency market capitalization for Solana reaches $78 billion despite its 68 million active wallets while Sui maintains 38 million active addresses but exists with $12 billion market value.

Competitors Gaining Ground

The Ethereum price has declined while its main competition consisting of Solana along with Cardano, Avalanche, and Sui actively expands its dominance in the market. The entire list of these competing cryptocurrencies now places among the top 20 cryptocurrencies and they surpassed ETH during this year.

Also Read: One Cent Dream: ChatGPT Predicts Factors Helping Shiba Inu (SHIB) Hit $0.01

Charles Hoskinson, Cardano founder and former Ethereum co-founder, raised concerns:

“Ethereum is running out of time and is in imminent danger of becoming the next MySpace or BlackBerry.”

Leadership Uncertainty

A decrease in Ethereum prices occurs at the same time as internal management problems within the network occur. Listeners spread rumors that Vitalik Buterin would leave his leadership position at Ethereum during the early months of 2025 when the Ethereum Foundation underwent a complete restructuring process. ETH develops roadmap uncertainty as development teams openly clash about their priority needs.

Trump Administration Support

A few positive circumstances nevertheless remain active amid the current Ethereum price decline. Through the Digital Asset Stockpile program the Trump administration identified Ethereum as a core technology for American blockchain advancement. Ethereum stands as an investment for World Liberty Financial an institution which has ties to the Trump family members.

Market price levels would not receive any boost because there are no confirmed new Treasury purchases.

Also Read: Currency: 3 Ways the US Dollar Is Being Dumped Right Now

Investment Outlook

Ethereum oversees 120.72 million ETH in its current circulation at the same time as sustaining $16.71 billion in daily trade transactions. Trading has amplified after the price decline according to the 54.93% increase in daily volume figures. Currently, the market reveals moderate liquidity through its 7.58% ratio between trading volume and market capitalization.

Dominic Basulto, financial analyst, warned:

“Digital assets need to be valued based on their future growth projections and not on past accolades or past performance. There are simply too many competitors these days, and Ethereum is starting to lag its biggest rivals.”

The Ethereum price drop analysis points to caution for investors. While its historical significance remains important, the combination of declining metrics, fierce competition, and leadership questions creates an uncertain investment case. The coming months will definitely determine if this 47% drop represents a buying opportunity or perhaps the beginning of a larger decline for ETH.