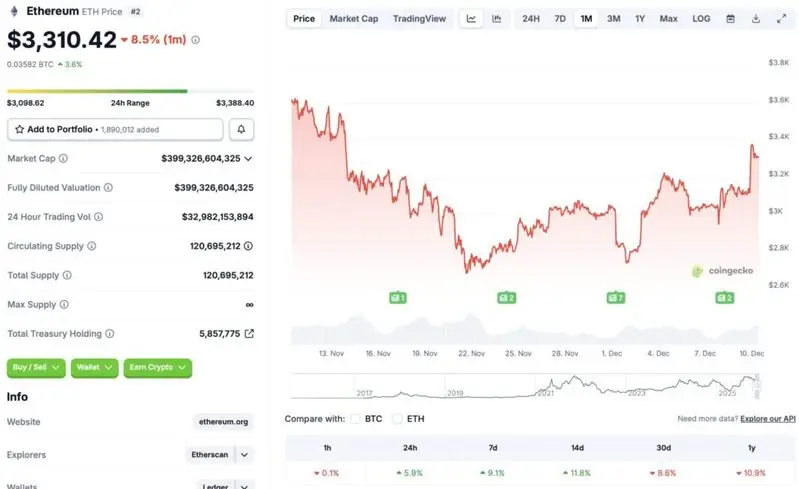

Ethereum seems to be experiencing a price rebound, rallying nearly 6% in the last 24 hours, 9.1% in the last week, and 11.8% in the 14-day charts, according to CoinGecko’s ETH data. However, despite the rebound, ETH’s price is still down by 8.6% in the last month and 10.9% since December 2024. Let’s discuss why Ethereum (ETH) has entered a rally, and if its price will continue rising.

What’s Behind Ethereum’s Price Rally?

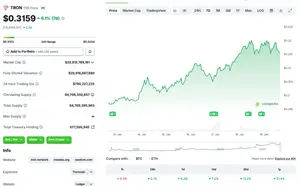

Ethereum’s (ETH) latest price surge comes amid increased whale purchases. According to Santiment data, ETH whales and sharks purchased nearly 934,240 ETH, worth roughly $3.15 billion over the last three weeks. The whale purchases came while retail investors sold about 1014 ETH.

Another reason for Ethereum’s (ETH) rally could be the anticipation of another interest rate cut after Wednesday’s Federal Open Market Committee (FOMC) meeting. There is a high chance that the Federal Reserve will roll out another 25 basis point interest rate cut. The cryptocurrency market could enter another bull run if rates are further reduced.

Thirdly, many financial institutions anticipate Bitcoin (BTC) to hit a new all-time high in 2026. Grayscale and Bernstein both claim that BTC may be pivoting from its 4-year cycle. Both institutions predict BTC to hit a new all-time high next year. Bernstein anticipates BTC to breach the $150,000 mark in 2026 and the $200,000 mark in 2027. Ethereum (ETH) could be reacting to the bullish outlook for Bitcoin (BTC). BTC hitting a new peak will likely trigger a market-wide rally.

Also Read: Not $5K or $8K, Fundstrat Lee Predicts Ethereum Price Hitting $62K

However, the cryptocurrency market could fall prey to fresh volatility. Macroeconomic uncertainties and slow economic growth could prompt investors to adopt a risk-averse approach. Such a scenario could lead to Ethereum (ETH) losing steam and facing a correction. How the market pans out is yet to be seen.