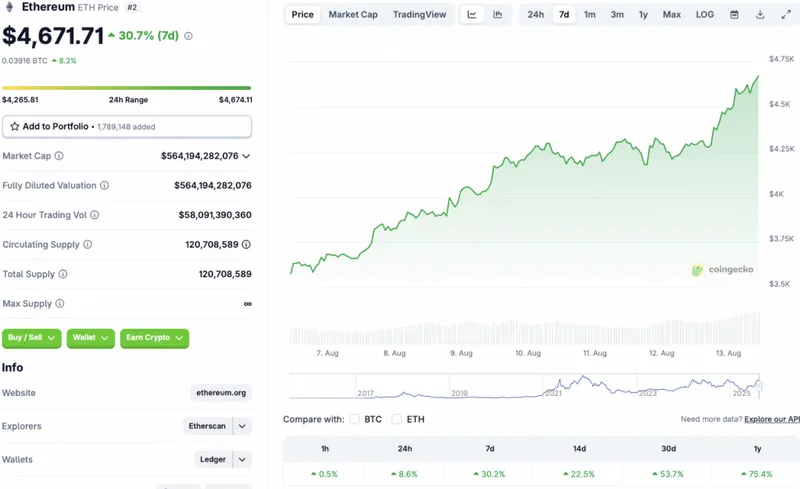

Ethereum (ETH) is experiencing a massive price breakout. The asset has reclaimed the $4,671.71 price point, a level last traded at in November 2021. According to CoinGecko’s Ethereum statistics, ETH’s price is up 8.6% in the daily charts, 30.2% in the weekly charts, 22.5% in the 14-day charts, 53.7% over the previous month, and 75.4% since August 2024. Ethereum (ETH) is currently down by just 4.2% from its all-time high of $4,878.26.

Will Ethereum Hit a New All-Time High This Week?

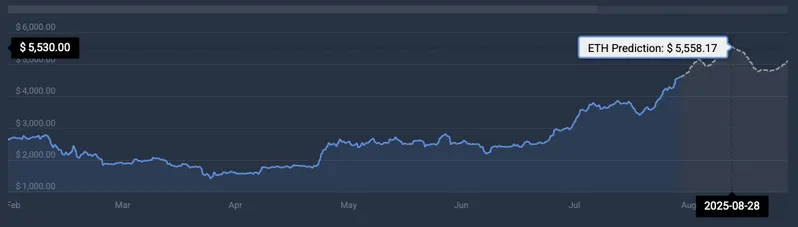

If ETH continues to rise at its current pace, it may hit a new all-time high in the next 24 hours. According to CoinCodex ETH analysts, it will continue to rally over the next few weeks. The platform anticipates the asset to trade at $5,558.17 on Aug. 28. Hitting $5,558.17 from current price levels will entail a rally of nearly 19%.

What’s Pushing the Asset’s Price?

Ethereum’s (ETH) latest upward momentum is likely due to the US CPI numbers coming in at 2.7%, lower than the expected 2.8%. The lower CPI figures have led to high optimism for an interest rate cut in September. A rate cut will likely lead to more investments in risky assets, such as cryptocurrencies. ETH and the larger market could continue rallying under this pretext.

ETH’s rally may have been further propelled by high ETF inflows. ETH ETFs recently saw more than $1 billion in inflows, the largest since their US debut. ETH’s rally may see continued push if ETF inflows continue to pour in.

Also Read: Ethereum Beats Mastercard: The Next Big Price Target Revealed

However, there is also a chance that ETH could face a correction in the coming days. The global economy is yet to recover from President Trump’s tariff blows. Trade wars and geopolitical tensions could present a barrier to the crypto market. How things unfold is yet to be seen.