Ethereum (ETH) has been making headlines in the cryptocurrency market today. The altcoin has emerged as the talk of the town for various reasons. While the second-largest cryptocurrency continues to struggle in terms of price, the daily transaction fees of the network saw a massive plunge. Amidst all these updates, the community is expecting a rise towards $4,000 or at least recovery for ETH this month.

Also Read: Unlock Wealth: 2 Altcoins to Invest in for Millionaire Status by 2030

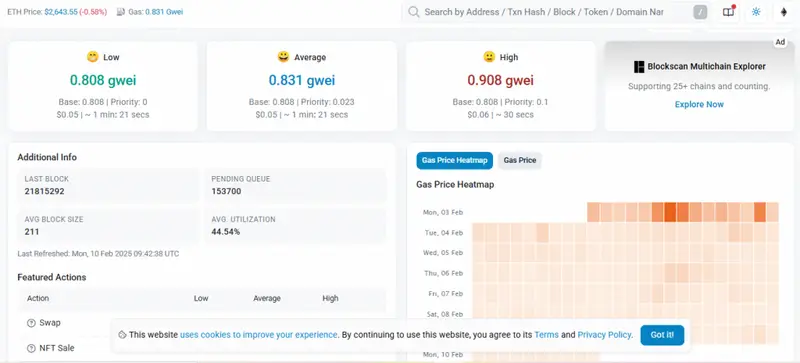

Ethereum’s Gas Price Dips

At 0.808 gwei, or $0.05 per transaction, the average gas charge for an Ethereum transaction has fallen to its lowest point in the previous five years. For Ethereum, which has risen to as high as $100 in previous years, this drop in gas prices marks a historic occasion. The value of gas surcharges peaked in 2020 at 709.7 gwei, or around $196 per transaction. The NFT trend, growing interest in DeFi applications, and greater network traffic were the primary causes of this growth.

During the time of writing, ETH was trading at $2,643.92 following a 0.29% drop over the past 24 hours. Earlier this month, the altcoin was trading much above the $3,000 mark. But things took a major turn as ETH dipped to a low of $2,159.28. In addition, Ethereum failed to follow in the footsteps of Bitcoin (BTC) and record a new peak. The altcoin hit an all-time high of $4,891.70 about three years ago and is currently trading 45% below this milestone.

Also Read: Complete List Of Donald Trump’s Trade Tariffs

February Price Prediction

According to data from CoinCodex, Ethereum might increase by up to 1.38% in February, reaching an average price of $2,683.14 for the month. The range of the expected price change is $2,218.34 to $3,115.88. When compared to the present price, this trend can provide a potential return of 17.73%.

Also Read: Gold Hits $2,892 Record High as US Investors Sell Amid Trump Tariffs