The global economic development is constantly evolving, with new dynamics reshaping the markets on the go. In the current regime, we are witnessing a rise of new global financial narratives with metals taking a lead. Moreover, new market developments are hinting at parallel processes, with the governments now boldly following direct pathways to reach the top of the market radar. The latest market news involves three trending narratives, including the Greenland agenda, the soft US dollar, and the global stock agenda evolving at a lightning pace. What are some new developments that are happening in these aforementioned sectors above? Let’s find out.

Also Read: Rare Earth Minerals Demand Surges as Geopolitics Heat Up: Invest Now?

Trending Market Developments

1. The Greenland Agenda

The US President Donald Trump has now vowed to buy Greenland. Trump is leaving no stone unturned to add Greenland to the domain of the United States, and has particularly curated a “board of peace,” and is busy onboarding countries to join his new agenda.

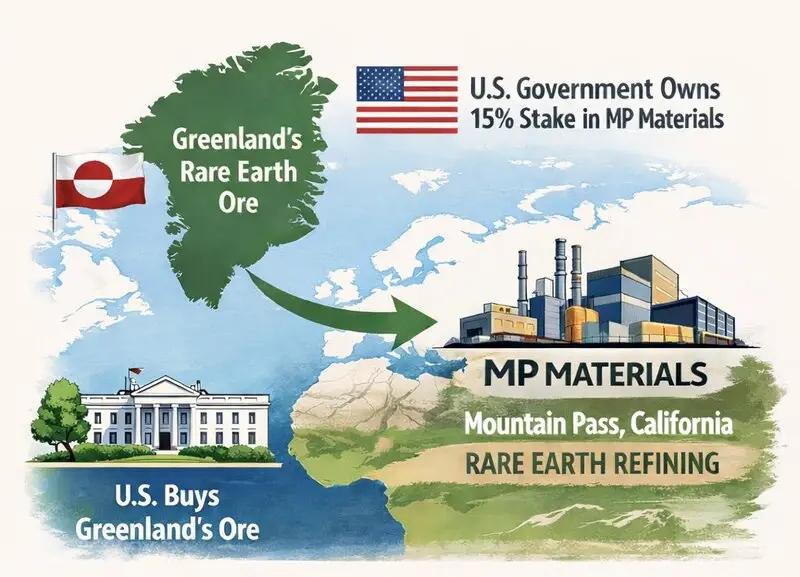

Per a latest post by the Kobeissi letter, the economic repercussions of this “purchase” (if the US manages to do so) could be massive, as Greenland houses some of the largest rare earth deposits. With the AI boom taking over the world, these rare earth deposits and control over the sector may end up delivering an edge to countries in the sector of tech development and advancement.

“It keeps coming back to rare earths. Greenland holds an estimated 1.5 MILLION metric tons of rare earth reserves. This makes Greenland the 8th largest holder of rare earth reserves. Even more important? Greenland had effectively ZERO rare earth production in 2025. Production is near zero due to lack of funding and necessary infrastructure. Greenland is estimated to have up to $5 trillion worth of natural resources. This is equivalent to roughly ~20% of US GDP and almost entirely untapped. Greenland is incredibly valuable.”

2. The US Dollar

The US dollar is currently basking in its soft era, exploring its lowest price thresholds at this time. With gold and silver rallying to new highs, particular triggered by Trump’s EU tariffs, the dollar may continue to explore new lows for months to come. In the middle of this, Peter Schiff, a notable economist, has called the dollar out, stating how Bitcoin and USD are both doomed. He shared how diversification towards gold and silver is the right thing to do at the moment, as the US dollar and USD-denominated assets are on their way to plunge even more.

“By the end of the year, holders of U.S. dollar–denominated assets and cryptocurrencies, including Bitcoin, will be substantially poorer than they are today. In contrast, holders of non-dollar–denominated assets and precious metals will be significantly richer. Which will you be?”

3. Global Stocks

The global stock narrative is also changing constantly. The current era belongs to tech and energy stocks, with the latter scaling rapidly and now gaining central attention. Per the latest post by the analyst, energy sector stocks may be the next big thing among the markets; a rapid AI boom and demand for data centers may trigger this surge.

“The energy sector is gearing up to be one of the most dynamic arenas in the coming years, fueled by an explosive surge in demand from AI data centers, electric vehicles, and industrial growth. Global electricity use is projected to rise by 3.3% in 2025 and 3.7% in 2026, driven largely by power-hungry data centers that could see their consumption double by 2030, from around 448 TWh to 980 TWh worldwide.”

Also Read: Is the US Dollar Falling? Why Crypto May Absorb Fiat, Not Kill It