US spot Ethereum ETFs have set a new inflow record. According to SoSoValue ETH data, ETH ETFs witnessed more than $1 billion in inflows on Aug. 11, 2025. This marks the largest inflow for the financial vehicle. BlackRock’s ETHA led the pack with $640 million. ETH ETFs have seen consistent inflows over the last few months. The ETF inflows are the likely reason behind ETH reclaiming the $4000 mark.

Ethereum Dips Despite Record ETF Inflows

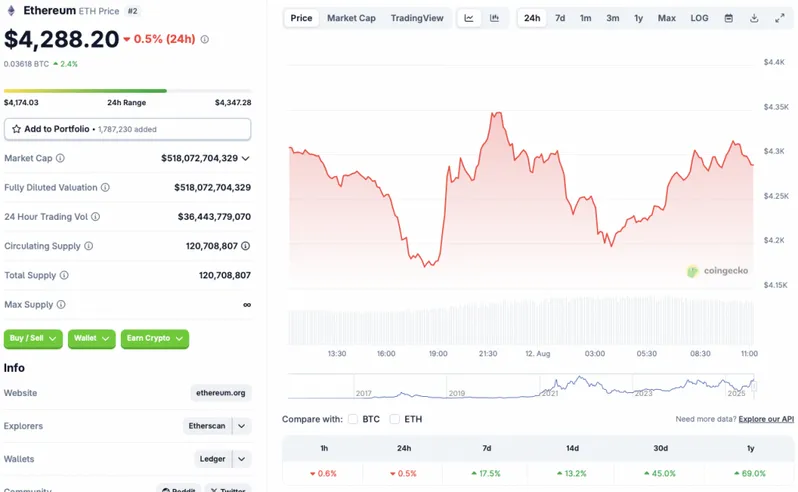

Ethereum (ETH) faced a 0.5% correction today, despite record ETF inflows on Aug. 11. While the asset is red in the daily charts, it continues to trade in the green zone in the other time frames. According to CoinGecko Ethereum data, ETH has rallied 17.5% in the weekly charts, 13.2% in the 14-day charts, 45% in the monthly charts, and 69% since August 2024. The second-largest crypto by market cap is currently down by 11.9% from its all-time high of $4,878.26.

ETH’s correction is likely due to a market-wide pattern. The cryptocurrency market seems to be reacting to the Consumer Price Index (CPI) data due later today. Many experts anticipate a slight increase in the CPI and Core CPI data. The CPI data will influence the Federal Reserve’s Jackson Hole meeting later this month. The figures will likely set the tone for what market participants can expect from the monetary policy in September.

Ethereum’s (ETH) and the larger market correction may have been further amplified by global trade wars and economic uncertainty. President Trump’s tariff spree has had substantial consequences on global economics.

Also Read: Ethereum ICO Buyer Turned $6,200 Into $85 Million: Begins Selling

There is a high chance that the Federal Reserve will cut interest rates in September. A rate cut could lead to increased risky investments. Such a scenario could lead to Ethereum (ETH) climbing to a new all-time high.