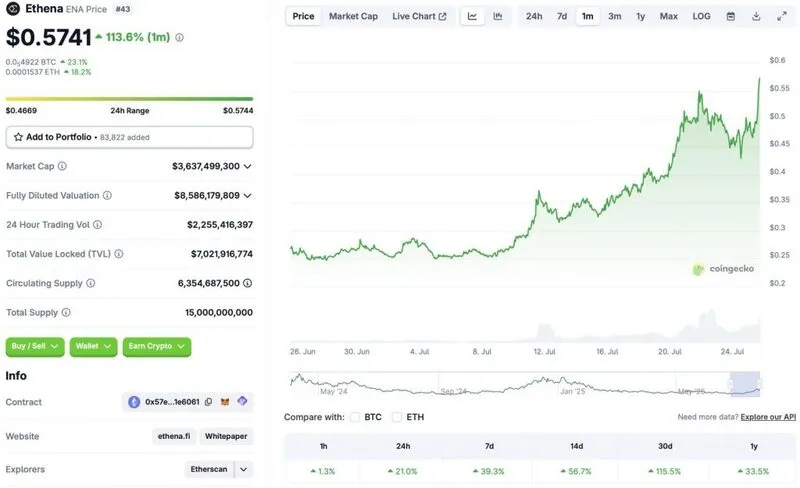

The cryptocurrency market has faced a substantial dip over the last few days. The correction follows a market upswing earlier this month. Bitcoin (BTC), XRP, and BNB hit new all-time highs amid the surge. While the larger crypto market seems to be pulling back, Ethena (ENA) seems to be going against the market trend. Despite the market dip, Ethena (ENA) has rallied 21% in the last 24 hours, 39.3% in the weekly charts, 56.7% in the 14-day charts, 115.5% in the monthly charts, and 33.5% since July 2024, as per CoinGecko’s ENA data.

Why Is ENA Rallying?

While Ethena (ENA) rallies, a majority of the assets in the market are facing a dip. ENA’s surge could be due to developments around the project’s stablecoin. The project’s synthetic dollar, USDe, seems to be causing quite a buzz in the crypto community. The stablecoin does not back the coin with dollar reserves. Instead, USDe uses long positions on spot Ethereum (ETH) combined with short positions on futures contracts to maintain its dollar peg.

ENA’s rally may fade out as the hype around its stablecoin dies down. It is unlikely that ENA will continue its rally, given the bearish market environment. The cryptocurrency market has faced a substantial selloff over the last few days. Market participants are likely keeping their eyes glued to the upcoming FOMC meeting on July 29. They will most likely look for clues regarding the Federal Reserve’s next move on the US monetary policy.

Also Read: What Trump’s Crypto Report Could Mean for Your Portfolio

The Federal Reserve may decide to finally cut interest rates after its next meeting. President Trump has repeatedly asked Fed Chair Jerome Powell to cut interest rates. Trump has gone as far as to say that he’d fire Powell if given the chance. A rate cut could lead to money re-entering the crypto market. Such a scenario could lead to ENA continuing its rally.