Eric Trump’s Bitcoin firm, American Bitcoin Corporation, is set to go public through an all-stock merger with Gryphon Digital Mining. The company just announced this crypto miner deal, which represents a major expansion of the Trump family’s cryptocurrency investments and, right now, this Nasdaq merger deal is attracting quite a lot of attention from investors and analysts alike.

Also Read: US Stocks: Dow Jones Jumps 1,000 Pts as US-China Pause Tariffs

Trump’s Crypto Miner Merger Sparks Nasdaq Buzz And Market Debate

The merger agreement between American Bitcoin and Gryphon Digital Mining has certainly created quite a stir in investment circles. At the time of writing, American Bitcoin will operate as the combined company and several financial reports that have been released expect it to trade on Nasdaq under the ticker symbol ABTC.

Deal Structure and Ownership

Hut 8 Corp. majority owns Eric Trump’s Bitcoin firm, and President Trump’s sons also partly own it. The companies expect to complete the transaction with Gryphon Digital Mining by October 2025, which is just a few months from now. Existing shareholders, including the Trump brothers, will maintain approximately 98% ownership of the merged entity, so they’ll still have a very significant stake in the business.

Eric Trump stated:

“Our vision is to create the most investable Bitcoin accumulation platform in the market.”

Eric Trump, who currently serves as chief strategic officer, will continue in this role after the merger is finalized. This crypto miner Gryphon Digital partnership is highlighting the growing trend of institutional crypto adoption that we’ve been seeing lately.

Market Response and Performance

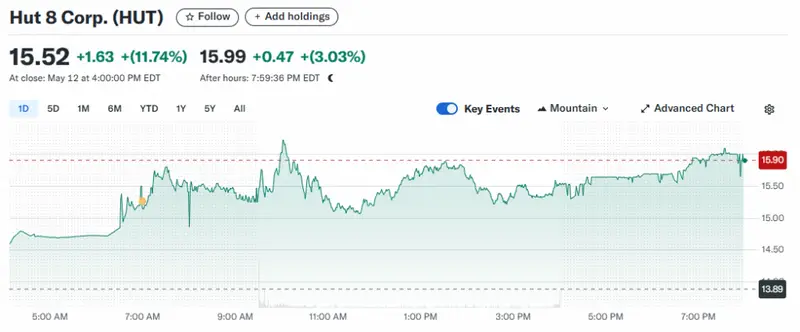

The announcement of this trump crypto news has triggered a pretty dramatic market response. Shares of Gryphon jumped by an astonishing 280% to reach $2.04 in premarket trading, while Hut 8 shares also rose by more than 11% to hit $15.52, which is quite a significant jump for both companies.

Also Read: Solana to Hit $200? SOL Block Traders Expect Big Gains by June

Strategic Vision

In March, the company just recently launched American Bitcoin with an exclusive focus on Bitcoin mining and also strategic reserve development. The company is aiming to establish itself as a major player in the Nasdaq merger deal landscape, which is becoming increasingly competitive.

Asher Gennot, CEO of Hut 8, said:

“This deal marks the next step in scaling American Bitcoin as a purpose-built vehicle for low-cost Bitcoin accumulation at scale. By taking American Bitcoin public, we expect to unlock direct access to dedicated growth capital independent of Hut 8’s balance sheet, while preserving long-term exposure to Bitcoin upside for our shareholders.”

Bitcoin mining operations function much like traditional data centers, with specialized computer hardware that requires substantial electricity to run properly. Eric Trump’s Bitcoin firm will be positioned to capitalize on the growing cryptocurrency mining sector, which has seen increasing interest from institutional investors.

Political Context

This expansion of the Trump family’s cryptocurrency investments coincides with President Trump taking several steps that have been favorable to crypto interests in Washington. His administration has ended some of the Biden-era enforcement campaigns against crypto companies, and this has created a more welcoming regulatory environment.

American Bitcoin actively promotes its connection to the Trump family in investor presentations and other materials. The company’s materials include statements such as “Crypto is the future” and “America must lead the way”. They clearly echo the president’s rhetoric on cryptocurrency and digital assets.

Also Read: Apple (AAPL) iPhone to Get a Price Hike: What Does It Mean for the Stock?

Business Expansion

This latest venture adds to the Trump family’s growing crypto portfolio. It includes World Liberty Financial and the popular meme coins $TRUMP and $MELANIA. The expansion of Eric Trump’s Bitcoin firm into public cryptocurrency mining marks their boldest digital asset move yet.

Taking American Bitcoin public creates new investor opportunities. The ownership structure keeps control with existing stockholders and overall, this Nasdaq merger positions the company for growth in institutional crypto adoption.