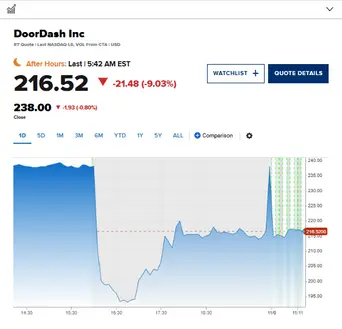

DoorDash stock actually plunged 14% in after-hours trading on November 5th after the company missed Q3 earnings expectations and also revealed a massive $3.9 billion stake in Deliveroo. Right now, DASH stock is sitting at $216.52, down from the $238.00 close, and Wall Street analysts are reacting pretty strongly to the weaker margins along with some aggressive spending plans for 2026.

DoorDash Stock Slides on Q3 Miss and Deliveroo Bet

The Q3 earnings numbers showed revenue of around $3.4 billion with 27% year-over-year growth, yet DoorDash stock was hit hard as profitability metrics came in below what investors wanted. Total Orders went up 21% to 776 million and Marketplace GOV actually rose 25% to $25.0 billion, but the adjusted EBITDA guidance of $710-810 million for Q4 fell short of the $806.8 million that analysts had been expecting.

CFO Ravi Inukonda had this to say about the business performance:

“when you look at the underlying cohorts, right, the demand on the underlying cohorts continues to be very strong. Both MAUs are growing, order frequency is growing.”

Also Read: [Related Article 2]

Investment Plans and the Deliveroo Deal Alarm Investors

The company is expecting to spend “several hundred million dollars” on some new initiatives in 2026, which really rattled Wall Street. Management actually defended the spending in the Q3 earnings release, stating:

“We wish there was a way to grow a baby into an adult without investment, or to see the baby grow into an adult overnight, but we do not believe this is how life or business works.”

DoorDash closed its $3.9 billion Deliveroo deal on October 2, and they’re expecting the UK company to contribute around $200 million to adjusted EBITDA in 2026. CEO Tony Xu stated:

“I think we have a great opportunity to be the leading local commerce platform there. I think a lot of the confidence of what inspired us to pursue the Deliveroo acquisition really came a couple of years ago after gaining confidence in working with Wolt.”

CFO Ravi Inukonda tried to reassure investors:

“Nothing has changed about how we operate the business.”

On the topic of 2026 margins, Inukonda explained:

“I would expect the margins to be up slightly compared to 2025.”

Also Read: [Related Article 3]

What’s Next for DASH Stock

DASH stock is facing some uncertainty right now as investors are recalibrating their expectations around the technology platform investments along with the Deliveroo deal integration. The company expects to generate well over $100 billion in 2026, but at the time of writing, the path to get there now appears more expensive than what was previously communicated. Wall Street will be watching closely to see if DoorDash stock can actually balance growth investments with profitability improvements in the coming quarters.