According to Farside Investors, BlackRock’s Ethereum ETF purchased $102.9 million worth of ETH on Jan. 5, 2026. The world’s largest asset manager also purchased $287.4 million Bitcoin for its BTC ETF on Jan. 2, 2026, marking its most significant single-day BTC purchase in nearly three months. BlackRock seems to be amping up its purchases as we enter the new year. Let’s discuss if ETH’s price will rally following the financial institution’s big purchase.

Ethereum Rallies Amid BlackRock’s Big Purchase

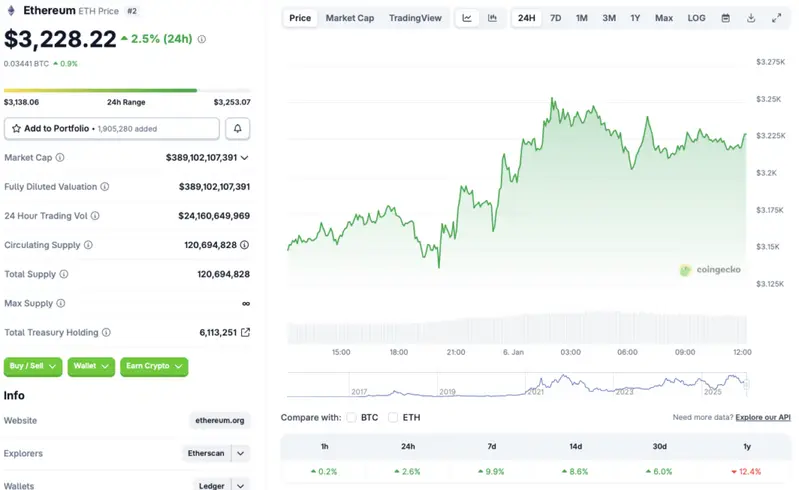

BlackRock’s big ETH purchase coincides with the asset registering big gains across nearly all time frames. According to CoinGecko data, Ethereum’s (ETH) price has rallied 2.6% in the last 24 hours, nearly 10% in the last week, 8.6% in the 14-day charts, and 6% over the previous month. However, despite the rebound, ETH’s price is still down by 12.4% since January 2025.

Ethereum’s (ETH) latest price rally could be due to increased ETF inflows, along with other bullish developments. The larger crypto market is also seeing significant price rallies, with Bitcoin (BTC) reclaiming the $93,000 price level. Ethereum’s (ETH) rally could be due to increased investor sentiment as we enter 2026. The rally have also stemmed from the Bank of America recently allowing advisors to recommend crypto assets to their clients.

Ethereum (ETH) may continue to rally over the coming weeks if market sentiment remains bullish. Many experts, such as Grayscale and Bernstein, anticipate Bitcoin (BTC) to climb to a new all-time high in 2026. BTC hitting a new peak could lead to Ethereum (ETH) seeing substantial growth.

Also Read: Ethereum Technical Setup Mirrors Pre-Rally Phase: Can ETH 2x Again?

However, macroeconomic conditions are still quite fragile. Fresh volatility could present new challenges to the crypto market. Ethereum’s (ETH) price could face a correction if market participants continue feeling the pressure. The risk-averse trend is still quite strong, pushing gold and silver to new heights over the last few months. The crypto market could suffer if the trend does not change.