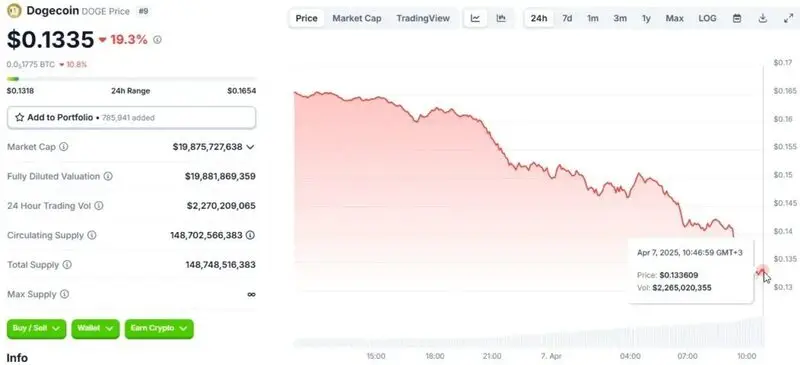

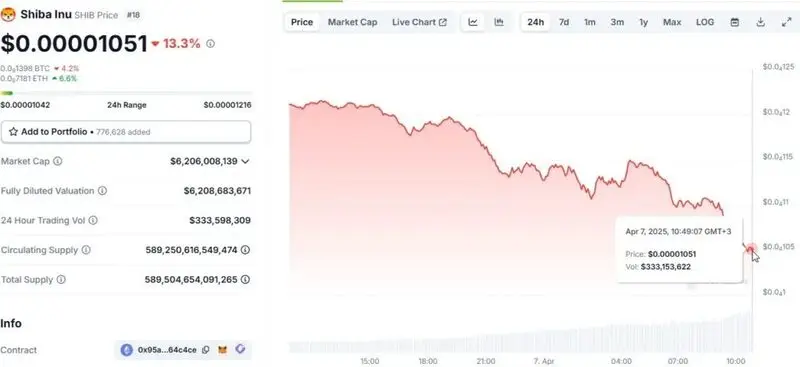

The Dogecoin and Shiba Inu crash has intensified over the weekend, with all major meme coins plunging dramatically across various exchanges. At the time of writing, the latest market data shows Dogecoin down a staggering 19.3%, while Shiba Inu is also falling about 13.3%, and Pepe coin is actually dropping around 15.1%.

Also Read: Markets Panic: Ackman Pushes Pause on Tariffs to Halt Crash

What’s Fueling The Meme Coin Crash And Where Prices Go Next

Trump’s Tariff Announcements Trigger Selloffs

Well, the primary driver behind the Dogecoin and Shiba Inu crash right now is President Trump’s recent tariff implementation.

A 25% tariff on Canada and Mexico has just begun, with additional tariffs on China also rising to about 20%. There is no wonder that such aggressive trade policies have sparked immediate retaliation from global trading partners.

Federal Reserve Chairman Jerome Powell had this to say:

While uncertainty remains elevated, it is now becoming clear that the tariff increases will be significantly larger than expected. The same is likely to be true of the economic effects, which will include higher inflation and slower growth.

The S&P 500 has experienced its worst drop in nearly five years, plummeting about 4.8% on Thursday followed by an additional 6% decline on Friday. This stock market bloodbath has definitely spread to cryptocurrencies, with the Dogecoin crash reflecting the heightened fear in speculative assets.

Critical Support Levels Under Pressure

Analysts claim that if $0.16 holds, then a rally to $0.57 could follow. However, breaking below this threshold might trigger a further Dogecoin and Shiba Inu crash down to possibly $0.06. Similarly, another analyst Master Kenobi warned that Dogecoin really needs to bounce off the $0.17 support level.

Master Kenobi stated:

If that doesn’t happen, the last hope lies at the $0.14 support level.

The analyst also suggested that breaking this support would likely “mark the end of DOGE’s bull run” and noted that PEPE might already be entering bear market territory, which is certainly concerning for investors.

Also Read: Top 3 Cryptocurrencies That Could Recover This Week

Multiple Market Pressures Compound Losses

The Fed’s ongoing quantitative tightening policies continue limiting liquidity flowing into cryptocurrencies and other risk assets. Despite Trump actually calling for immediate rate cuts, Powell’s apparent reluctance to adjust monetary policy has contributed to the ongoing Dogecoin and Shiba Inu crash that we’re seeing unfold.

Additional controversy also surrounds Trump’s proposed crypto strategic reserve, with some industry figures like Gemini co-founder Tyler Winklevoss arguing against including altcoins in such a program. This uncertainty has further weakened meme coin prices across the board.

Trading Volumes Remain High Despite Price Drops

Despite the price collapse, trading activity remains surprisingly robust across major meme coins. Dogecoin has recorded approximately $2.27 billion in 24-hour volume, with Shiba Inu seeing around $333 million and Pepe handling over $1 billion in trades. These elevated trading levels indicate active position adjustment amid the ongoing Dogecoin Shiba Inu crash.

Also Read: Trump’s Tariff Chaos Wipes $6T from Markets as JPMorgan Warns 60% Chance of Global Recession