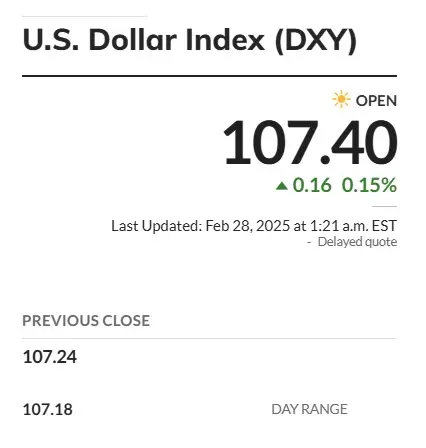

Despite de-dollarization, the US dollar rebounded in price as the DXY index, which measures its performance climbed above the 107 mark. The DXY index is now trading at the 107.40 level after surging 0.15% on Friday. The US treasury yields rose this month making the greenback strengthen in the charts. The move pushed gold prices below the $2,900 range making the XAU/USD index trade at $2,860 on Friday’s opening bell.

Also Read: Bitcoin Crash: How Low Can BTC Fall In The Current Market Scenario?

Leading investment bank Goldman Sachs predicted the future of the US dollar as de-dollarization looms. The global bank weighed the pros and cons of the currency markets and wrote in the latest note to stakeholders that the greenback will make a comeback.

Also Read: Nvidia (NVDA) Stock Falls 8% Following Poor Q1 2025 Outlook

Goldman Sachs Predicts the Future of the US Dollar Amid De-Dollarization

Global investment bank Goldman Sachs wrote in a note that the US dollar could get a boost despite de-dollarization as Trump’s tariffs could uplift the greenback. Goldman Sachs strategists Karen Reichgott Fishman and Lexi Kanter wrote that the US dollar looks attractive due to the tariffs.

Also Read: What’s Happening With Tesla (TSLA) Stock?

Trump has vowed to protect the US dollar amid the onslaught of the de-dollarization agenda kick-started by developing nations. “Ultimately, not all tariffs are equal when it comes to FX,” the strategists wrote in a note. “But given the unwind of premium in key crosses in recent weeks, we once again think tariff risks look underpriced, making long dollar exposure now look even more attractive.”

Therefore, currency investors can take long positions in the US dollar now as its prospects look “more attractive”. Local currencies are under pressure due to tariffs and the USD is coming out on top. The Indian rupee has fallen to a lifetime low while the Chinese yuan and the Japanese yen have dipped to yearly lows. The development indicates that tariffs are working against de-dollarization and placing the US dollar on top.