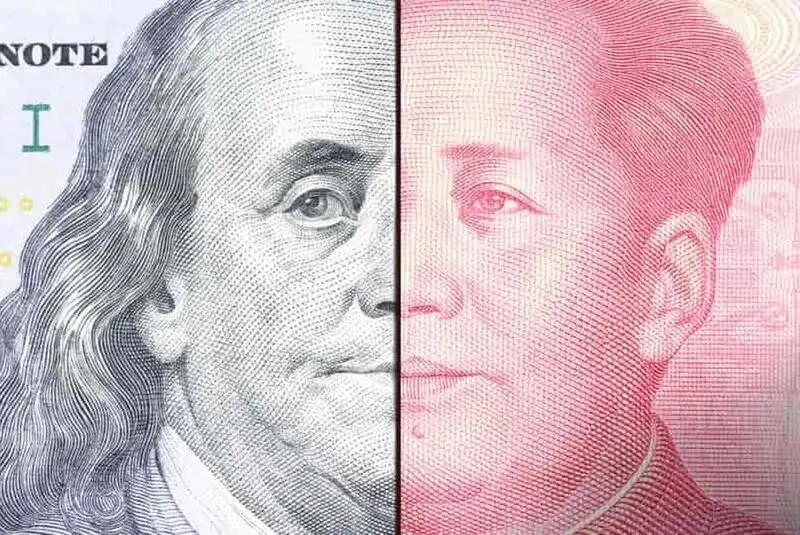

China is spearheading efforts to internationalize the yuan amid the US tariff mayhem. The nation has consistently been putting efforts into pushing the Chinese Yuan as a global currency and is busy forging ties with ASEAN to direct the Yuan’s global usage to new levels. This method is one of China’s recent pushes towards de-dollarization as it bolsters the intention of China to push yuan-centric payments across the globe to reduce reliance on the US dollar.

Also Read: Shiba Inu or XRP: Where Should You Bet for Profits In May 2025?

China Is Busy De-Dollarizing

Per a recent Reuters report, Chinese President Xi Jinping is currently touring Southeast Asia. His official visit is marked with a solid agenda, one that promotes close ties with the ASEAN countries and, at the same time, helps the nation push its Chinese yuan internalization to new levels.

In this wake, the People’s Bank of China is spearheading efforts to bolster yuan usage, banking on the US tariff mayhem to achieve the aforementioned target. This has been done via PBOC-controlled financial service firm UnionPay, a network enabling cross-border payments in yuan in countries like Vietnam and Cambodia. UnionPay is ensuring a nuanced yuan usage method by enabling the southeastern countries to facilitate transactions in yuan for tourists and small businesses using the QR code system.

In addition to this, PBOC’s offshore yuan standby currency swaps have hit a new high. The statistics showed nearly $4.3 trillion worth of transactions being settled in Yuan in February alone.

This move also outlines China’s long-term vision to liberate the world from Western financial regimes.

“The United States weaponizing tariffs has cast doubt over U.S. asset safety, undercut trust in the dollar, and shaken the greenback’s global status. That, in turn, has made yuan assets more attractive and will help broaden cross-border use of the Chinese currency.” E. Yongjian, vice general manager of Bank of Communications’ research department, told a seminar on yuan internationalization.

Also Read: Goldman Sachs: Hedge Funds Make Shocking Bank Stock Move

US Dollar in Trouble?

The phenomenon of de-dollarization has once again been gaining steam, especially after the US tariff ordeal sparked trade war fears. President Donald Trump’s aggressive tariff stance has been touted as a primary catalyst sparking anti-dollar regimes.

“Disrupting the economy through tariffs is possibly the wrong way to go about it,” Sharma said. Now, the weakening US dollar is further complicating his strategy. The dollar’s decline has already made imports more expensive and US exports cheaper, essentially achieving the same result as tariffs. However, the shrinking value of the dollar is putting inflationary pressure on the US economy. Which means that any further escalation of tariffs could inadvertently worsen the problem.” Said Ruchir Sharma, a notable investor and author

Also Read: Cryptocurrency: Pepe (PEPE) Vs Dogecoin (DOGE): AI’s 2025 Profit Prediction