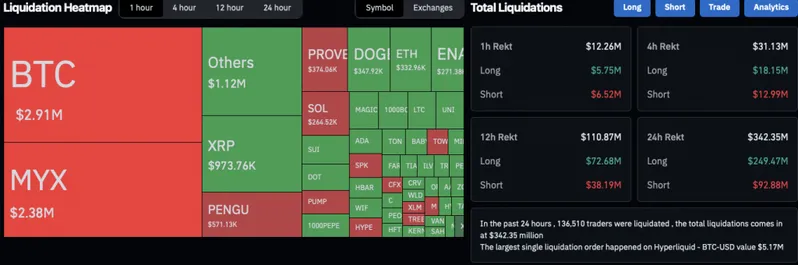

The cryptocurrency market dip continues its downward trajectory after one of its most significant rallies in July. According to CoinGlass liquidation data, the cryptocurrency market has experienced $343 million in liquidations over the last 24 hours. The sell-off comes as Bitcoin’s (BTC) price falls to the $113,000 level.

Bitcoin Falls, Others Follow

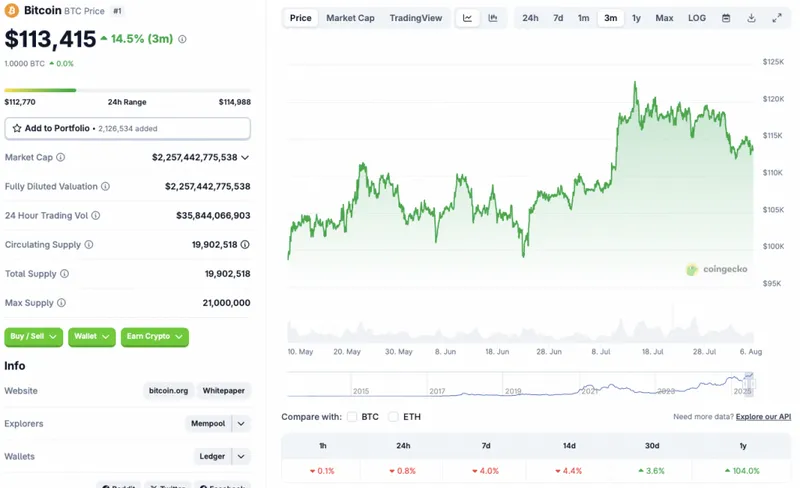

BTC’s price has dipped to the $113,000 level for the first time in nearly one month. According to CoinGecko’s BTC data, the asset is down 0.8% in the daily charts, 4% in the weekly charts, and 4.4% in the 14-day charts. BTC has maintained some gains in the monthly and yearly charts, rallying 3.6% and 104%, respectively.

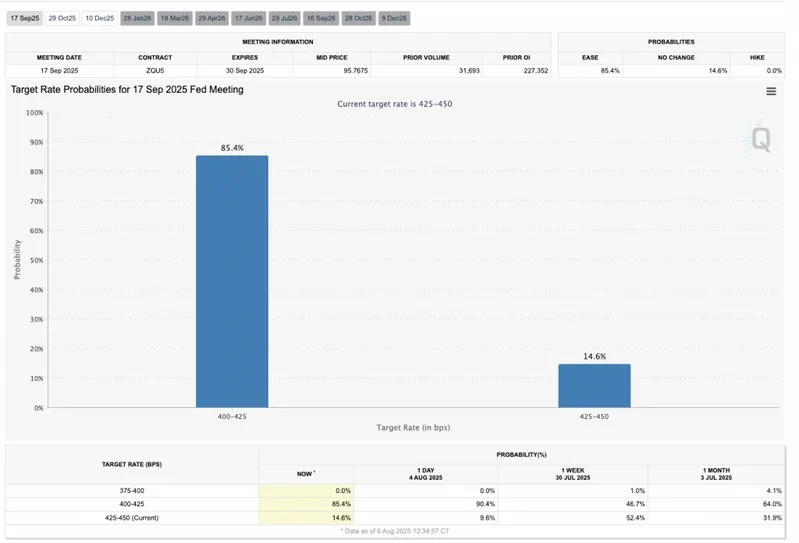

Bitcoin (BTC) and the larger cryptocurrency market dip was likely triggered by the Federal Reserve’s decision to keep interest rates unchanged. The worse-than-expected jobs data may have further spooked market participants. According to the Bureau of Labor Statistics (BLS) nonfarm payroll increased by just 73,000 for the month. The lackluster figures prompted President Trump to fire BLS Commissioner Erika McEntarfer. The agency is now looking for a new candidate to replace McEntarfer.

BTC’s dip also follows on the heels of President Trump’s new tariff spree. Global trade wars and uncertainties around the tariff situation has caused much confusion among investors. BTC and the larger crypto market among among the riskiest assets, and have faced the brunt of the matter.

Also Read: Banks Choose Gold Over Bitcoin & USD—Here’s Why

Many entities anticipate the Federal Reserve to cut interest rates in September. According to CME FedWatch tool, there is a 85.4% chance that the Federal Reserve will drop interest rates by 25 basis points next month. Goldman Sachs, Wells Fargo, and Citigroup also believe that the Federal Reserve will cut rates in September.

Bitcoin (BTC) may experience a rebound if the Fed drops rates and borrowing becomes easier.