Trump’s crypto debanking order preparations are actually underway right now as the administration reportedly plans to investigate alleged discriminatory banking practices against cryptocurrency companies and also conservatives. With August 7 crypto tariffs approaching, traders are focusing on three made in USA tokens – Injective (INJ), Stellar (XLM), and also Zebec Network (ZBCN) – that could see some significant price movements amid the political debanking report developments.

🚨JUST IN: DONALD TRUMP REPORTEDLTY TO SIGN EXECUTIVE ORDER PROBING DEBANKING OF CRYPTO FIRMS AND CONSERVATIVES

— BSCN (@BSCNews) August 5, 2025

Trump’s Crypto Debanking Order Fuels Buzz Around Made In USA Tokens

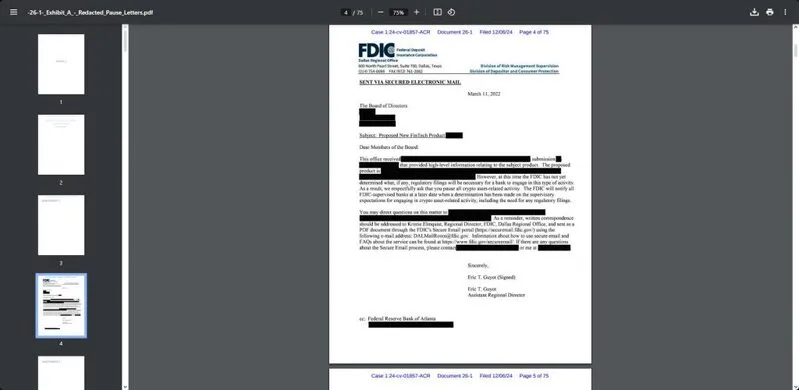

The Trump crypto debanking order targets what critics are calling “Operation Chokepoint 2.0,” which is the alleged systematic denial of banking services to crypto firms during the Biden administration. Banking regulators would be directed to examine potential violations of equal credit laws and also consumer protection regulations, with violating institutions facing financial penalties along with enforcement actions.

Nathan McCauley, CEO of Anchorage Digital, had this to say about the debanking experience:

“We had a bank that we had a growing relationship with for a number of years, who basically on a dime, decided to turn off our bank account.”

This political debanking report investigation has actually energized made in USA tokens as the August 7 crypto tariffs announcement approaches right now.

1. Injective (INJ) Shows Bullish Momentum

INJ has surged by 10% in the last 24 hours, with the Relative Strength Index moving above 50.0. If the Trump crypto debanking order provides some regulatory clarity, INJ could flip the $14.14 resistance into support and also rally toward $15.42. However, selling pressure could actually push it below $13.01 support.

2. Stellar (XLM) Targets Key Resistance

XLM increased by 13% over the last 24 hours, trading at $0.4166 below the $0.4245 resistance. The 50-day exponential moving average provides support for this made in USA tokens rally right now. If the August 7 crypto tariffs create favorable conditions, XLM could target $0.4450 and potentially even $0.4701.

Also Read: Goldman Sachs Cuts India GDP Forecast as Trump Threatens 25% Tariffs

3. Zebec Network (ZBCN) Emerges as Dark Horse

ZBCN has risen 27% over the past week, trading at $0.0051 near resistance levels of $0.0057 and also $0.0052. The Squeeze Momentum Indicator signals bullish momentum for this emerging made in USA tokens project. If the political debanking report creates some positive sentiment, ZBCN could surge toward $0.0059.

Caitlin Long, founder and CEO of Custodia Bank, stated:

“Trump’s crypto executive order excludes the Fed & FDIC from the digital asset working group. Both tried to kill the industry through debanking & especially targeted my company.”

The Trump crypto debanking order could actually reshape banking relationships with crypto companies, potentially benefiting these American-made tokens as the August 7 crypto tariffs deadline approaches right now.

Also Read: De-Dollarization Rose Under Biden, It’s Dying Under Trump