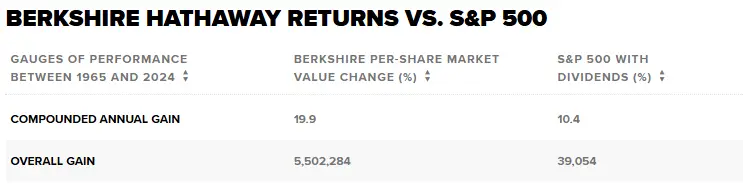

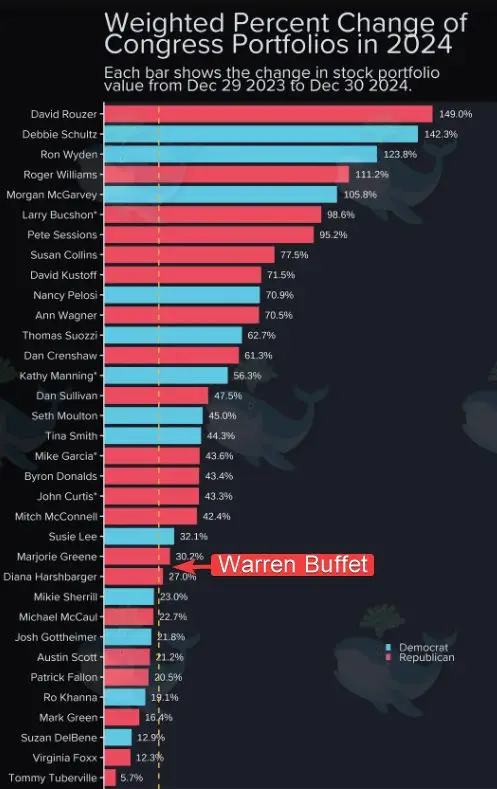

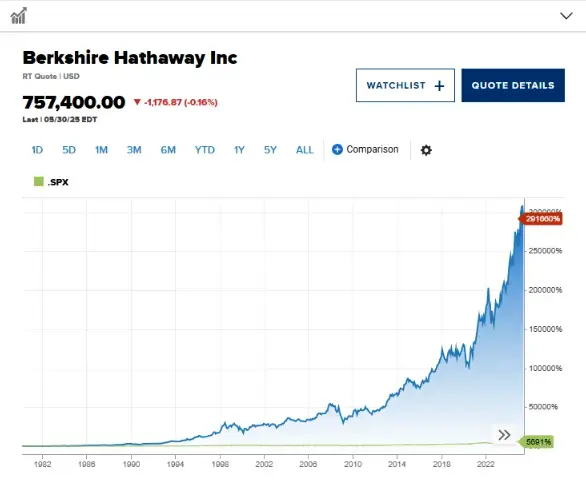

Congress stock trades generated massive returns in 2024, with lawmakers achieving gains up to 149% that significantly outpaced Warren Buffett’s legendary investment performance. While Buffett’s Berkshire Hathaway delivered a 5,502,284% return over six decades with a 19.9% compounded annual gain, congressional trading patterns in Nvidia stock, Coinbase, and also NGL Energy Partners have sparked fresh insider trading concerns and calls for reform right now.

Also Read: Congress Members Bet Big on These 3 Stocks – Find Out Which!

How Congress Beat Buffett With Phone Trades in Nvidia and Coinbase

Based on the 118th Congress data, 46% of lawmakers own individual stocks, with 189 Representatives and 54 Senators actively trading. These congress stock trades have generated exceptional returns that outpace even professional investors. The trading activity shows a clear concentration in technology stocks, particularly Nvidia stock and also Coinbase positions.

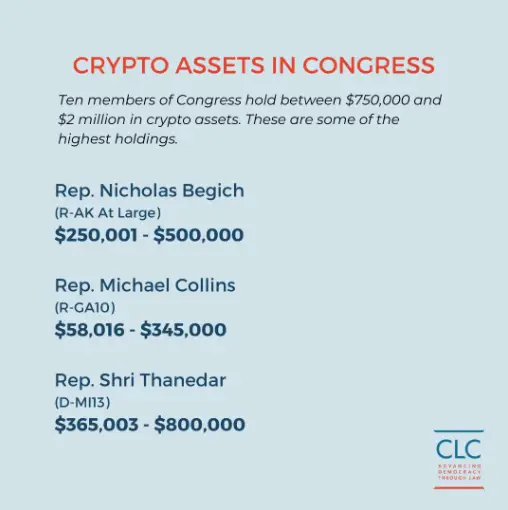

The most profitable congress stock trades occurred through quick “phone trades” executed via brokers ahead of major policy announcements. At the time of writing, several members hold between $750,000 and $2 million in crypto assets, with Representative Shri Thanedar holding $365,003 to $800,000 in cryptocurrency investments.

Record-Breaking Congressional Holdings

According to the congressional disclosure data, Representative Nicholas Begich holds $250,001 to $500,000 in crypto assets, while Representative Michael Collins holds $58,016 to $345,000. These congress stock trades and crypto holdings often coincide with committee assignments related to financial services and also technology regulation.

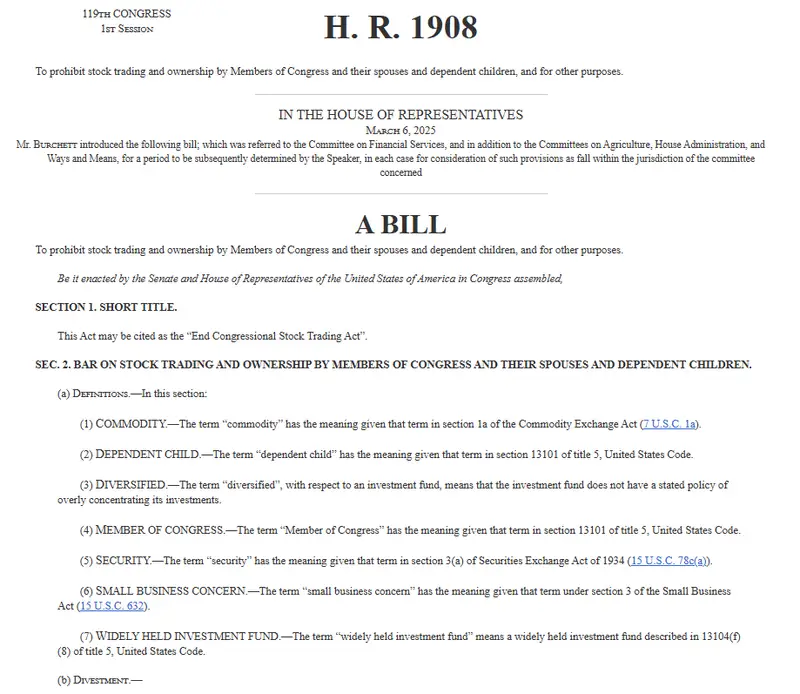

The STOCK Act had three principal objectives related to congressional stock trading: increase public trust in Congress, increase transparency with new filings required within 30 days of member trades, and also penalize members for insider trading by clarifying that securities laws apply to Congress.

Technology and Energy Stock Focus

The most profitable congress stock trades concentrated on Nvidia stock, Coinbase, and also NGL Energy Partners. The data shows that cryptocurrency assets in Congress are becoming increasingly significant, with ten members holding substantial digital asset portfolios right now.

The weighted percent change data reveals dramatic portfolio performance variations among lawmakers in 2024, with some achieving returns that would be considered exceptional for professional fund managers at the time of writing.

The Insider Trading Question

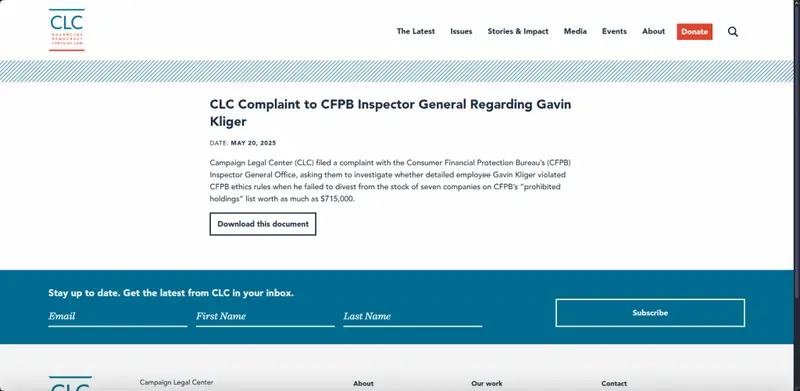

The Campaign Legal Center reported Gavin Kliger to the ethics office for not removing himself from stocks in seven companies which had a value of up to $715,000. This story highlights that there are still concerns about government officials breaking insider trading rules.

Also Read: Warren Buffett’s $330B Portfolio Holds 58% in Just 4 Power Stocks

Because of the impressive gains in congress stock, calls for far-reaching changes have increased. It is clear from how congress performs compared to Buffett’s success that important issues in the system must be identified and resolved right away by regulators as well as reformers. It appears from the weighted percent change in Congress portfolios in 2024 that traders in these portfolios are likely profiting far more than they should, leading many to doubt if current rules are fair.