The recent operations of Kazakhstan work to accelerate global de-dollarization initiatives by creating complications for OPEC’s unified market position worldwide. The recent statement from Commerzbank indicates that ongoing organizational conflicts will bring substantial changes to international trade patterns.

Also Read: Musk’s X and Dogecoin (DOGE): ChatGPT Predicts Price Surge Or Crash?

Kazakhstan’s Move Tests OPEC Unity—Will De-Dollarization Reshape Global Oil Markets?

Kazakhstan’s Actions Threaten De-Dollarization Progress

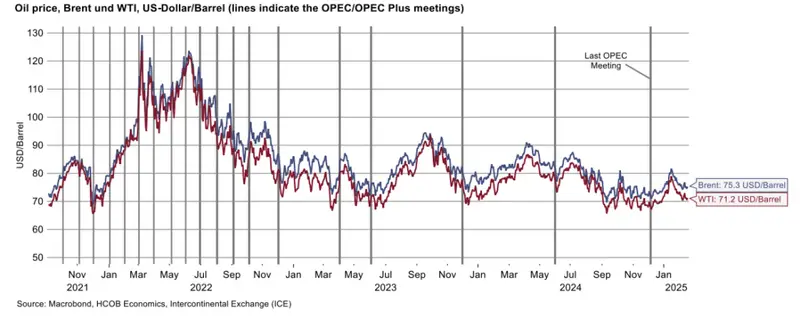

The decision by Kazakhstan to violate OPEC+ production limitations has resulted in serious market instability for oil at the moment. Overproduction by the country produces ongoing challenges to OPEC unity during a crucial phase for the organization’s operations.

Commerzbank’s commodity analyst Carsten Fritsch said:

“Given this situation, it is hardly conceivable that Kazakhstan will limit oil production as planned, let alone compensate for the current overproduction with larger production cuts.”

OPEC+ Responds to Oil Policy Challenges

The rise of de-dollarization risks intensifies due to retaliatory economic measures that OPEC+ member nations have started against Kazakhstan. Further market instability for global oil will arise during the upcoming weeks due to the current initiatives.

Fritsch warned:

“These decisions are likely to be motivated by the fact that Kazakhstan is constantly exceeding its agreed production volumes. If Kazakhstan continues to violate the OPEC+ agreement, this could result in a further increase in production by the other countries out of anger, which would put more pressure on oil prices.”

Also Read: Senators Rip Trump Over Crypto Dinner: ‘Pay-to-Play’ Fears Explode!

Membership Questions and OPEC Cohesion

The situation raises questions about Kazakhstan’s continued OPEC+ membership amid growing de-dollarization pressures in global oil markets and such tensions may continue to escalate.

Fritsch noted:

“The question therefore also arises as to whether Kazakhstan remaining in OPEC+ might do more harm than good. In recent years, Angola and Qatar have left OPEC because membership no longer suited their respective interests. These departures did not have any negative consequences for OPEC.”

Kazakhstan’s energy minister has attempted to reassure members that the country “still sees itself as part of OPEC+ and is committed to cooperate constructively and to fulfill its obligations.”

Commerzbank Warning on Global Oil Markets

The recent banking alert from Commerzbank indicates that economic disagreements might possibly hasten globalization trends which reduce dependence on the US dollar throughout international oil deals. Multiple recent changes create effects that affect both OPEC organizational strength and worldwide petroleum market stability.

Also Read: Grayscale Warns: $61M Lost as SEC Delays Ethereum ETF Staking!

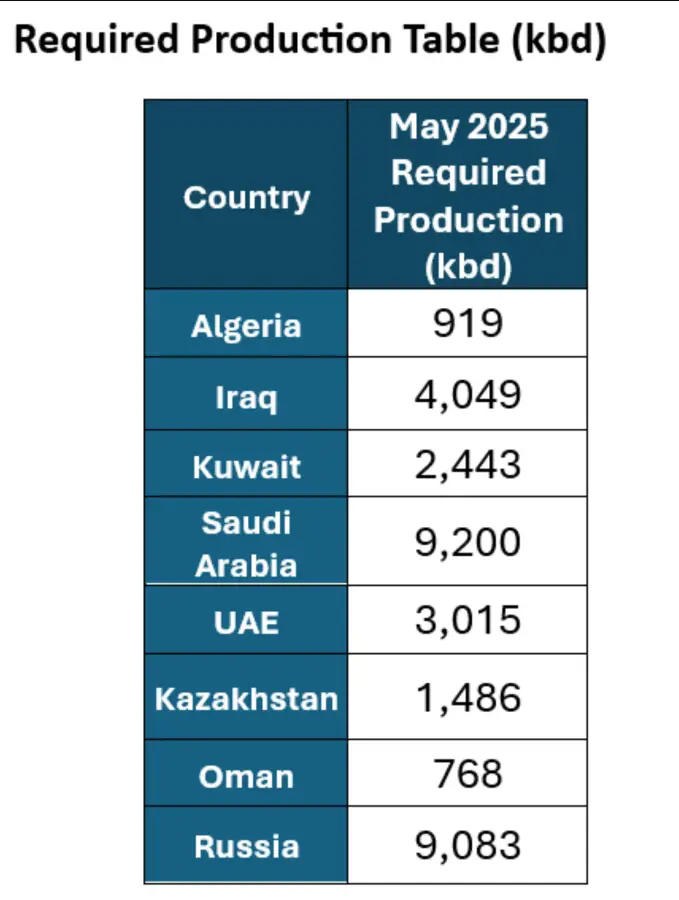

Members of OPEC+ have shown intense dedication to Kazakhstan’s oil policy breaches by authorizing further production boosts for May along with evaluations for June expansion.