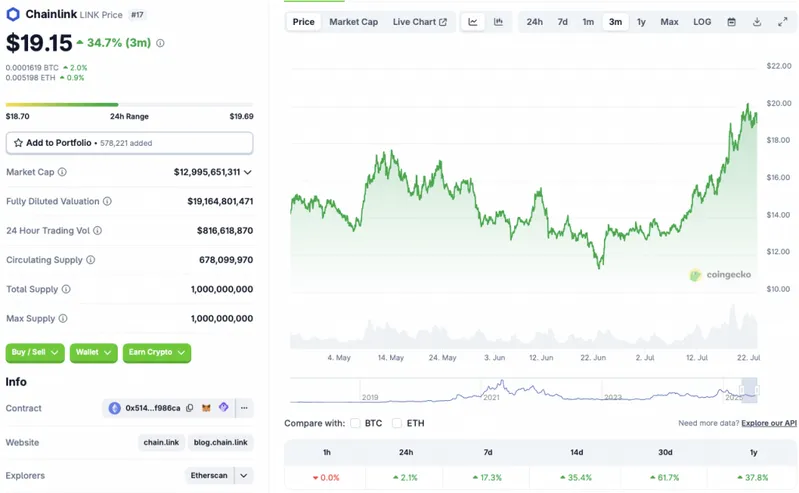

Chainlink (LINK) seems to be facing some resistance at the $20 mark. There is some demand in this area from February of this year. LINK last tested this price point in mid-February, without success. LINK’s price has rallied 2.1% in the last 24 hours, as CoinGecko reveals, 17.3% in the weekly charts, 35.4% in the 14-day charts, 61.7% over the previous month, and 37.8% since July 2024.

Can Chainlink Break Past The $20 Barrier By July End?

LINK’s latest rally follows the market-wide upswing. Bullish developments around pro-crypto legislation in the US and consistent high inflows into crypto-based ETF products have led to a substantial rally.

The latest bullish swing has led to several crypto assets hitting new all-time highs. Bitcoin (BTC) climbed to a new peak of $122,834 on July 14. Ripple’s XRP token hit a new high of $3.65 on July 18. Binance’s BNB coin also hit a new all-time high of $801.83 earlier today, July 23, 2025. The bullish reversal over the last few weeks could lead to LINK continuing its upswing.

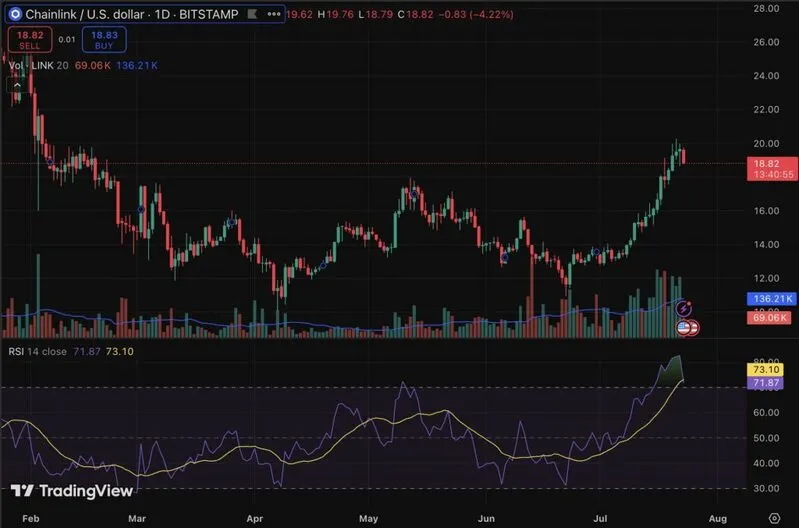

Chainlink (LINK) could very well breach the $20 mark as early as today. However, the asset’s RSI (Relative Strength Index) has crossed over to overbought levels. This could mean that investors may begin to book profits. Moreover, there seems to be considerable supply at this price point.

Also Read: Chainlink August Price Prediction: LINK to $28?

Bitcoin (BTC) has also registered some losses over the last day. The original crypto is down by 3.8% from its recent peak. The dip is likely due to investors booking profits after BTC’s recent climb. BTC dipping could lead to LINK facing a similar correction. BTC seems to have a supply gap at the $110,000 level. There is a chance that BTC could dip to this level over the coming weeks. BTC’s decline will likely lead to a market-wide correction.