CEA Industries stock (NASDAQ: VAPE) skyrocketed 600% in a single trading session on Monday. It ended the closing bell by surging 530.72% giving day traders phenomenal returns in a few hours. Just a week ago, its price was around the $9 mark, but it reached $57.58 due to the massive spike.

An investment of $1,000 in CEA Industries stock a week ago could have turned $6,500 to $7,000 today. That’s phenomenal returns on investment (ROI) as it takes years to even surge 600%. However, catching the shooting star is not as easy as it is said to be, as the gains occur unexpectedly, taking everyone by surprise.

Also Read: Meta Stock To Rise or Fall: How AI Will Dictate Q2 Earnings

Why Did CEA Industries’ Stock Rise 600%?

CEA Industries’ stock recorded an explosive move on Monday after it announced a major deal with two cryptocurrency firms. It collaborated with fintech firms 10X Capital and YZi Labs, announcing a private placement of $500 million investment to establish a publicly-listed treasury company under the BNB on-chain network.

The $500 million investment will be divided into two parts. An investment of $400 million in cash and $100 million in BNB cryptocurrency. BNB is the native token of Binance and is the fifth-largest cryptocurrency in the world in market cap. Its market capitalization currently stands at $115 billion and is trading at the $828 range on Tuesday. The deal made CEA Industries’ stock head north, attracting heavy bullish sentiments.

Also Read: TSLA at $316 Eyes $500 Target as Tesla Diner Pulls $47K Daily

Should You Invest Now?

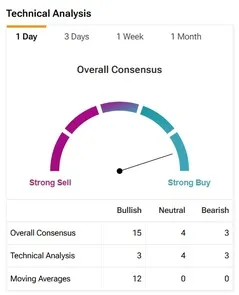

The technical analysis for CEA Industries stock points towards a ‘strong buy’, according to the latest stock research by TipRanks. The overall consensus remains bullish, indicating that it could surge further in the charts. VAPE’s 52-week high stands at $82; another rally could help it breach its previous high. For that to happen, VAPE needs to climb more than 45% in the charts. Investors with money they can afford to bet can take the risk from $57 to $82 next and book profits.